Veriff vs Sumsub: the smarter way to scale your business

Veriff is the preferred identity verification partner for the world’s biggest and best digital companies, including pioneers in fintech, crypto, gaming, and the mobility sectors. We provide advanced technology, deep insights, and expertise from our foundation in digital-first Estonia and are leading the digital identity revolution.

Ashley Nelson

About Veriff

Veriff is the preferred identity verification partner for the world’s biggest and best digital companies, including pioneers in fintech, crypto, gaming, and the mobility sectors. We provide advanced technology, deep insights, and expertise from our foundation in digital-first Estonia and are leading the digital identity revolution.

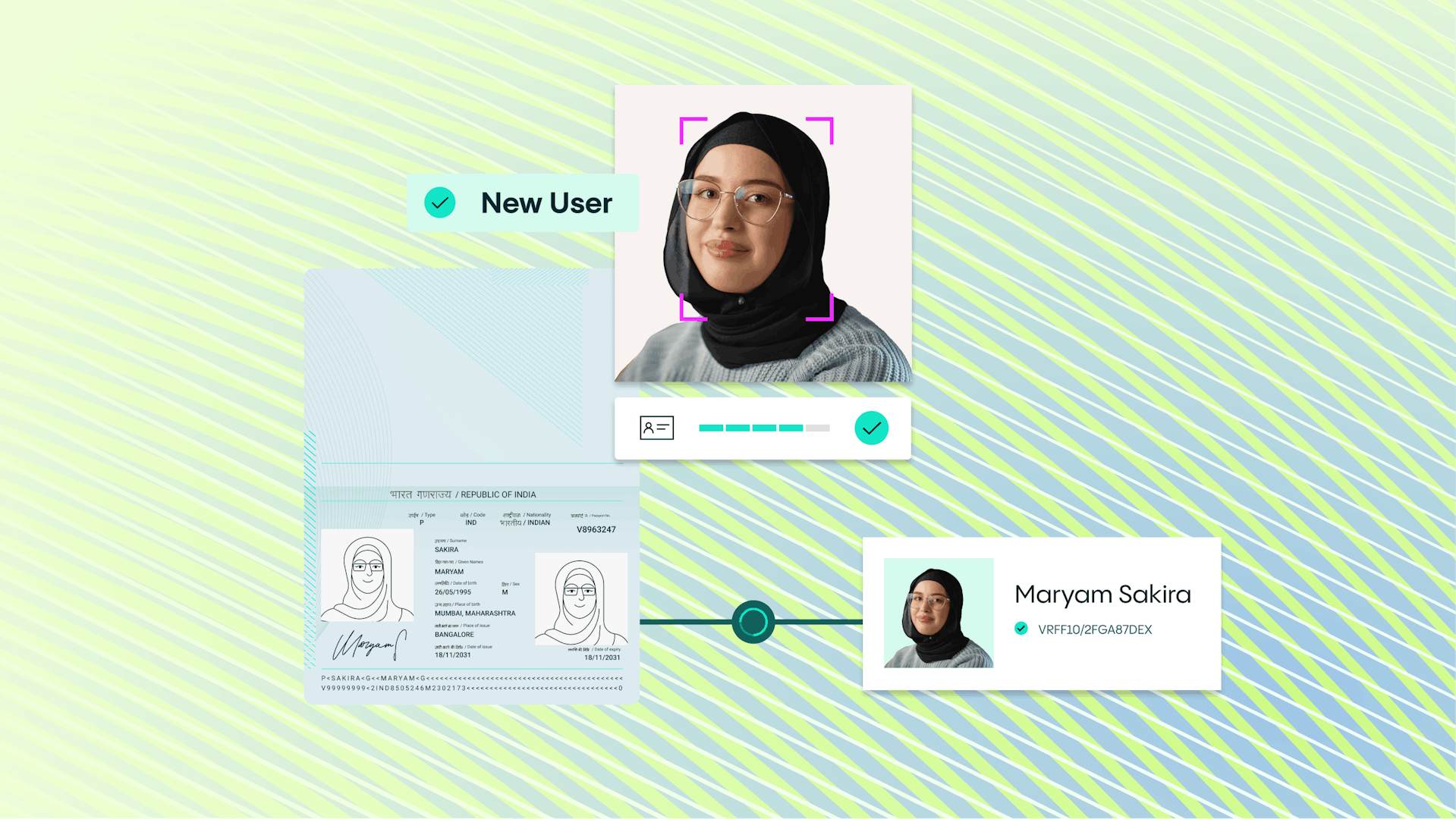

The partner of choice for businesses who need to rapidly and effortlessly verify online users from anywhere in the world, Veriff delivers the widest identity document coverage in the market. By supporting government-issued IDs from more than 230 issuing countries and territories and with our intelligent decision engine which analyzes thousands of technological and behavioral variables Veriff enables trust from the first hello.

And, with more than 550 people from 60 different nationalities and offices in the United States, United Kingdom, Spain, and Estonia, we are dedicated to helping businesses and individuals build a safer and more secure online world.

Veriff’s key products

Veriff continues to lead the market in providing innovative identity verification solutions. The current product suite includes all the tools you need to convert and onboard more real customers while stopping bad actors.

Veriff is the partner of choice for businesses who need to rapidly and effortlessly verify online users from anywhere in the world, with the broadest possible identity document coverage. By supporting government-issued IDs from more than 230 issuing countries and territories and with our intelligent decision engine which analyzes thousands of technological and behavioral variables Veriff enables trust from the first hello.

Veriff’s biometric authentication confirms that a returning user is who they claim to be. Our biometric analysis identifies and mitigates fraudulent activities such as account takeover and identity theft.

Simplify your Proof of Address (POA) process and make it easy for your users to verify their address. Veriff’s Proof of Address Capture reduces user friction, reduces your manual processes, and allows you to comply with regulations.

AML Screening

Veriff’s anti-money-laundering (AML) screening supports regulatory compliance. Our Identity Verification service alongside Politically Exposed Person (PEP) and sanctions checks, adverse media screening, and ongoing monitoring reduces business risk. Coupled with Veriff’s Identity verification, & proof of address, Veriff is able to provide an end-to-end solution helping businesses comply with their AML & KYC requirements from a single integration.

Database Verification Checks

Veriff's host of identity verification solutions are always designed to keep businesses compliant without making users' lives harder. Veriff's Social Security Number Verification is now an additional layer of protection for any identity verification program.

Veriff’s Age Estimation solution uses facial biometric analysis to estimate a user’s age without requiring the user to provide an identity document. This low-friction solution will enable you to convert more users faster.

How is Veriff different from Sumsub?

Onboarding

Let’s start from the beginning – with the customer onboarding process. Sumsub’s onboarding process requires double the amount of clicks compared to Veriff, which deflates conversions and makes for a less enjoyable user experience. Additionally, Veriff provides automated document detection, which keeps users from manually keying in their document information – which in turn cuts down on user error.

User experience

Unlike Sumsub's limited automated-only solution, Veriff offers a hybrid approach that provides highly trained expert verification specialists to supplement our AI-powered automated verification process. Our industry leading customer support and fraud risk teams provide critical insights to constantly optimize your solution in a cost-effective way and keep you ahead of your competitors.

Veriff offers a reinforced learning from human feedback (RLHF) plus hybrid approach. New identity documents are rapidly added to our document specimen library and tested to ensure they can be added to the automation process. Highly trained expert verification specialists are employed 24/7 to resolve any anomalies from the asserted documents. Our AI-powered automation rapidly verifies user identities from over 230 countries and territories Our industry leading customer support and fraud risk teams provide critical insights to constantly optimize your solution in a cost-effective way and keep you ahead of evolving fraud risk.

Hybrid vs. automated

Veriff offers hybrid and automated identity verification options. Our hybrid solution provides highly trained expert verification specialists to supplement automation. Customer support, and fraud risk teams provide customers with insights into evolving fraud risks and fine tune machine learning models to create more accurate and optimized solutions that are the most effective for your business.

With Veriff, you don't need to hire, manage, and train your internal teams to verify flagged or suspicious sessions. Veriff's hybrid approach provides an accurate and cost-effective identity verification solution.

Clarity on cost

Sumsub charges for resubmissions, so should your customers send in a blurry image or if their information on their ID document is obscured, Sumsub bills again for the new verification attempt.

At Veriff, all implementation costs are included, and there are no additional or 'hidden charges' to set up Veriff's identity verification service. Our tailored payment plans are ideal for growing businesses, ensuring you pay for the level of support you need right now and have an IDV partner who is ready to expand when you are.

Global coverage

Sumsub’s document coverage spans around 6,500 document types, while Veriff has the largest document database in the IDV space spanning more than 12,000 document types. This is vital for businesses who want to expand into new markets and territories.

Additionally, Sumsub advertises having 40 supported languages, including certain non-latin characters. That does not surpass Veriff’s language coverage, which is at 48 supported languages and dialects at present.

Partnership

Veriff's highly trained verification experts and documentation specialists, customer support, and fraud risk teams provide our customers with insights on evolving fraud risks and create optimized solutions that are the most effective for your business.

With dedicated Account Managers and Solutions Engineers, we are committed to supporting and guiding our customers through best-practice setup and ongoing advice to achieve optimum value from your use of Veriff’s Identity Verification solution.

Veriff customer success stories

TransferGo

"Our ambition to continuously improve the service and solutions we offer is rooted in our incessant focus on our customer. This shared culture of innovation and dedication to improving customer service makes Veriff a great fit for us. They will be critical in helping us deliver a best-in-class ID verification service that is secure, compliant and frictionless."

Milda Mačiulaitytė, Compliance Manager

CoinList

“In addition to their experience and knowledge in the identity verification space, the Veriff team has proven to be a great fit for CoinList. Veriff made our initial onboarding easy, and they continue to work closely with us to ensure their product is meeting our needs in the ever-changing landscape of identity verification. We are extremely happy to be working with Veriff and look forward to them playing an integral role in our KYC program as our company continues to grow and scale.”

CoinList

Why choose Veriff for your business needs?

Enhance user experience

A straightforward, minimal-step process to quickly establish a user's identity. Real-time feedback and automated detection of document type and country to aid users through the process. 95% of users are verified on their first try; the optimized user experience improves conversions and onboarding time.

Acquire new users faster and with a higher conversion rate

Any delays in the customer journey can lead to churn, frustrated potential users, wasted marketing spending, and high acquisition costs. Veriff’s market-leading hybrid identity verification solution enables users to get verified on the first try, taking an average of just 6 seconds. Acquire new, genuine users faster with a higher conversion rate, and realize commercial potential quicker.

Reduce operational costs

With Veriff, there are no implementation costs or ‘hidden charges’ for our leading identity verification service. In addition, our service includes a free-of-charge sandbox testing environment, which is vital for testing different identity verification use cases.

An approach that works for your business

Veriff’s hybrid approach provides an accurate and cost-effective identity verification solution; highly trained global experts supplement automation with any required manual verification so you do not need to hire, manage, and train your internal teams.

Expand into new markets

Veriff covers 12K+ documents, supports documents from 230+ countries and territories and supports 48 languages and dialects. We're by your side when you want to expand into new markets to drive new revenue opportunities.

Protect business reputation and reduce fraud risk

Veriff’s sophisticated and evolving anti-fraud features leverage and analyze over 1,000 data points during identity verification to verify more genuine users and keep bad actors out. Using a combination of network and device analytics, crosslinking, risk labels, face blocklisting, and velocity abuse checks, Veriff delivers a robust anti-fraud capability.

Schedule a demo of the Veriff platform today

Are you interested in learning more about how Veriff’s identity verification solutions can help your business? Get in touch with the team today to schedule a personalized demo that shows exactly what Veriff can do for you.

Disclaimer: All data in this article is from Veriff research, including user reviews. This guide was last updated in Q2, 2023.

Explore more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms.