How AML Screening works

Take a look at how AML screening works with Veriff's Identity Verification solution.

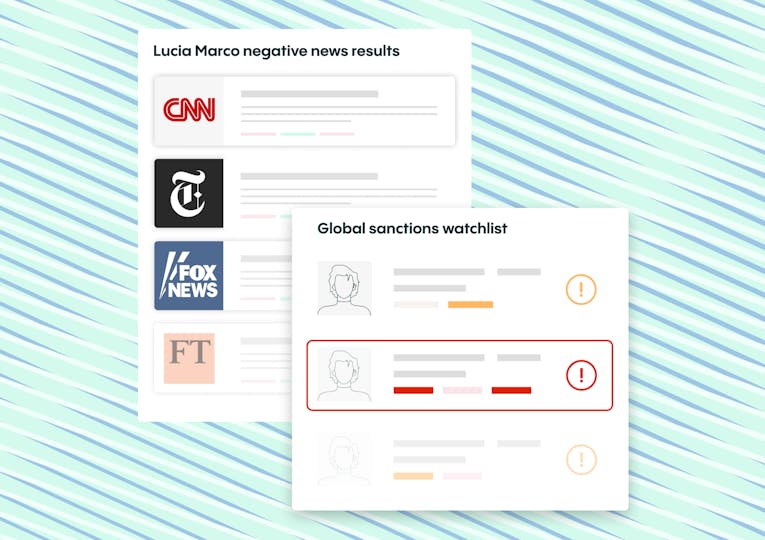

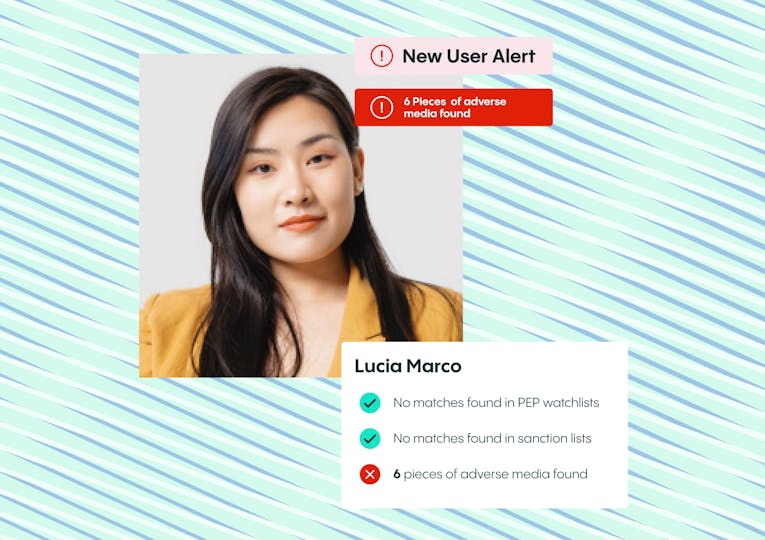

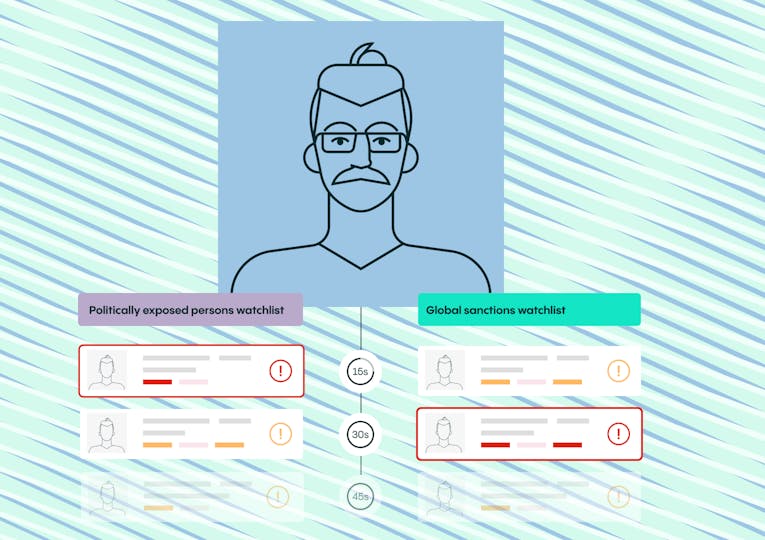

Comply with regulations and fight financial crime by screening users against global PEP and sanctions watchlists. Veriff’s list coverage is updated in real-time, bolstering confidence in your KYC process.

Even peripheral connection to crimes can indicate risk. Veriff screens for negative information and news to help businesses assess the potential risk exposure presented by their customers.

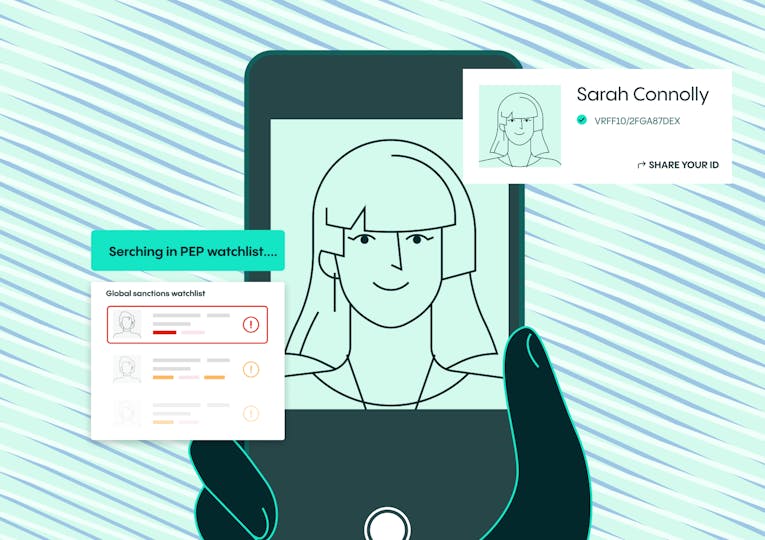

Political and regulatory environments change very quickly. With real-time data, continuously screen customer lists with Veriff’s ongoing monitoring of PEP watchlists, global sanctions lists, and adverse media. Automated screening notifies you if something changes with your existing or previously onboarded customers.

Veriff's AI-powered AML screening solution to mitigate business risk

Show regulators you take financial crime seriously while making onboarding quick and friction-free for your users.

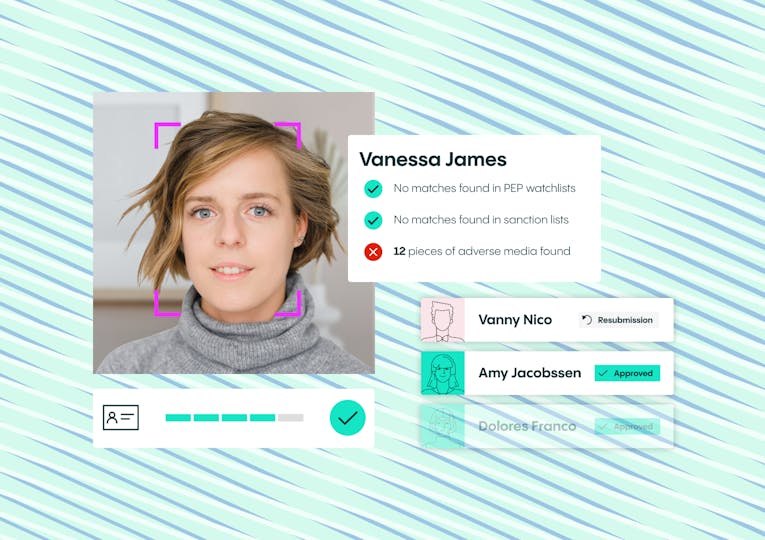

Accelerate onboarding checks while reducing risk

With Veriff, complying with KYC regulations doesn’t mean compromising the user experience. Our automated AML screening and ongoing monitoring solutions help keep your business compliant, mitigate risk, and keep out fraudsters while still creating a seamless experience for your genuine users.

Don’t compromise

Automate your AML screening with Veriff and create a user journey that gets you more genuine customers. Get in touch to get started.

Case studies

Certificates

Veriff is compliant with CCPA/CPRA, GDPR, SOC2 type II, ISO 27001, and WCAG Accessibility Guidelines.