How KYC Onboarding works

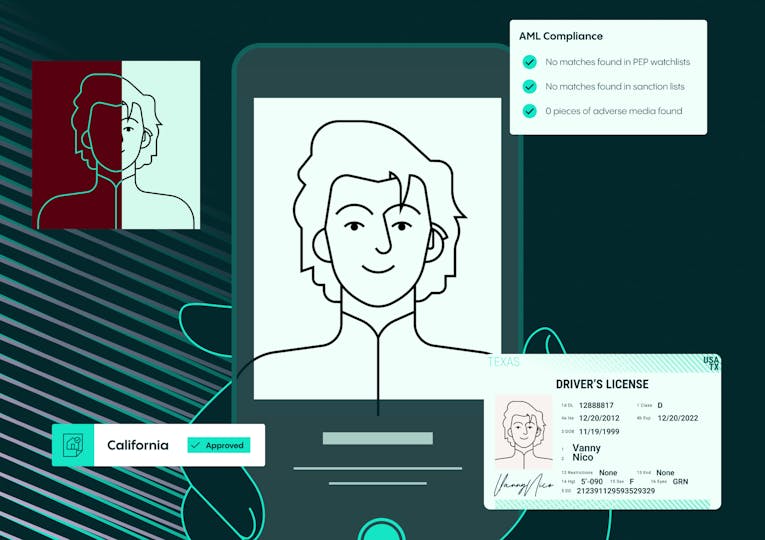

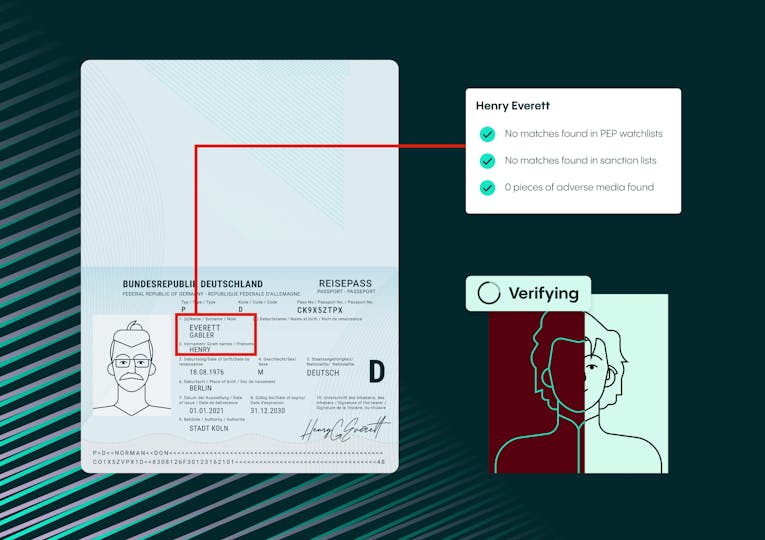

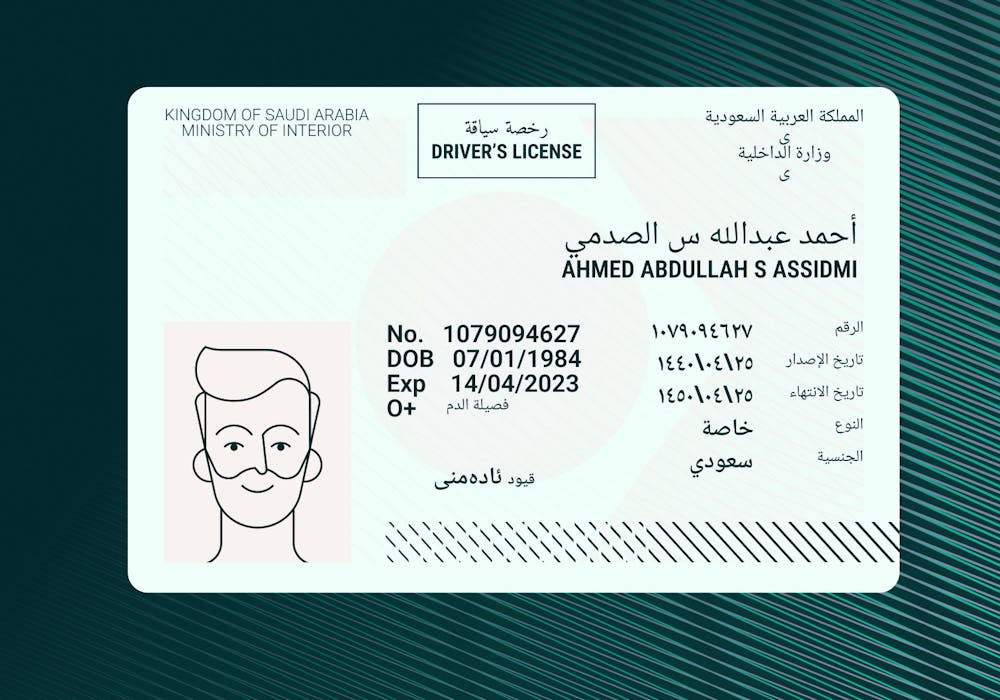

The user is asked to take a photo of their government-issued identity document and a simple selfie. This can be completed on a device and platform of their choice, as Veriff supports iOS, Android™, mobile web, and web SDK or API.

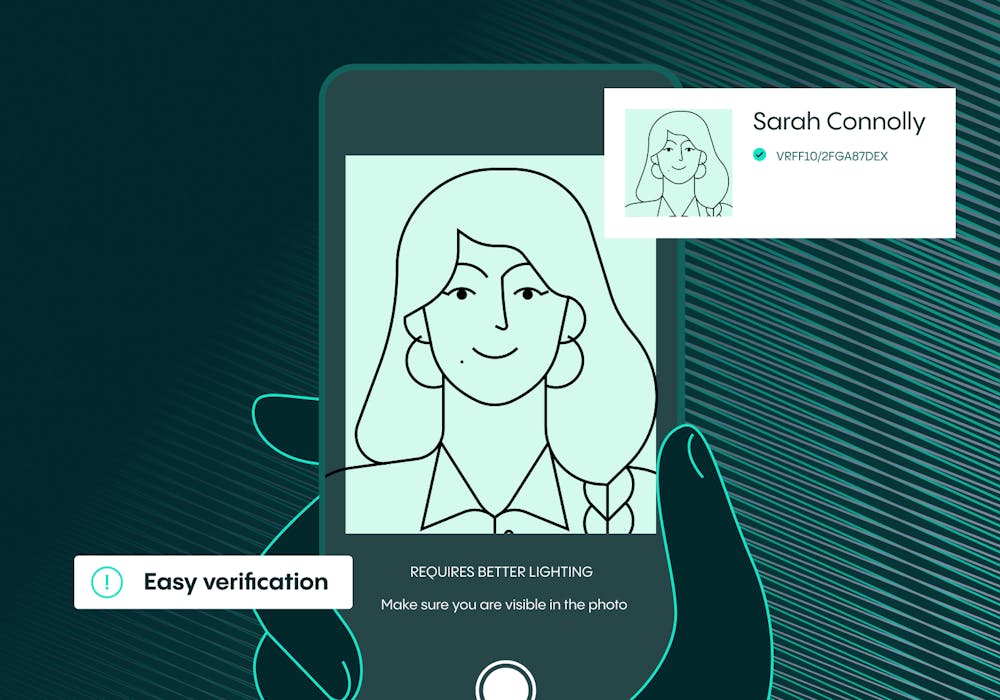

The user is asked to take a simple selfie and Veriff’s Assisted Image Capture lets them know immediately if there’s something wrong with the image. We quickly detect liveness and realness without asking users to move unnaturally or follow complex instructions.

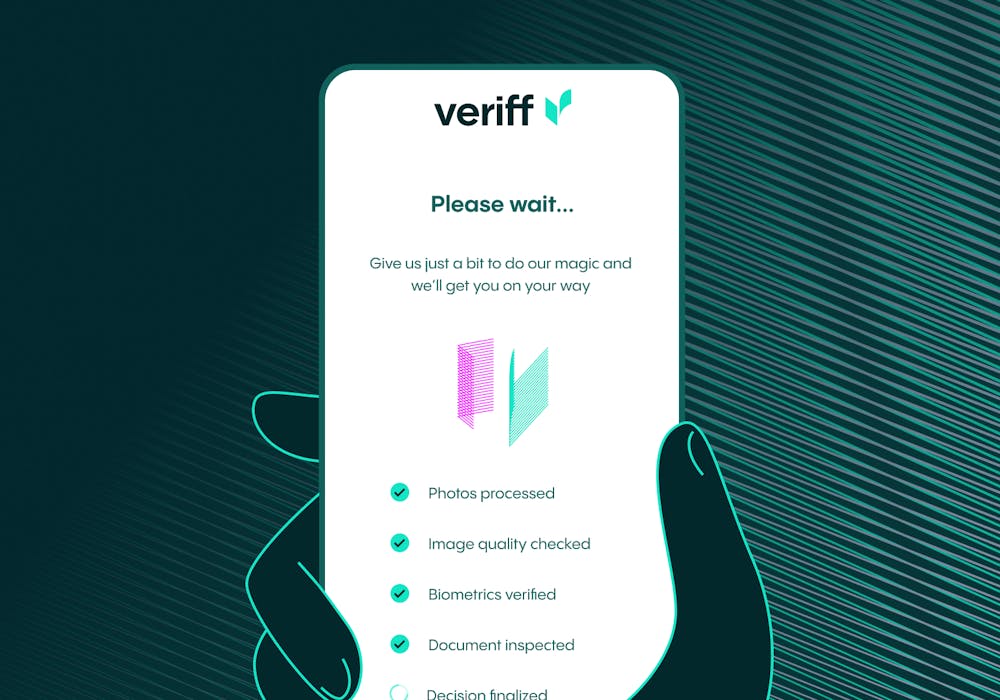

The data is securely sent to Veriff and our AI-powered identity verification technology provides a decision in a matter of seconds, based on the identity checks your business requires.

Get genuine users onboarded faster while fighting identity fraud.

Defense against online identity fraud made easy

All it takes is a selfie and a photo of an identity document for end users to get verified in a matter of seconds. Veriff’s integrated fraud prevention capabilities stop bad actors while bringing in more genuine customers for your business.

Talk to us and make verification easy for genuine people

Get in touch with a Veriff expert to learn more about how identity verification stops fraud while helping you convert more users.

Case studies

Certificates

Veriff is compliant with CCPA/CPRA, GDPR, SOC2 type II, ISO 27001, and WCAG Accessibility Guidelines.