Prevent fraud, build trust: The power of digital Identity Verification

Identity verification acts as a powerful safeguard against fraud! It confirms that there is a genuine person behind each action, validating their true identity. Discover more in our blog!

Raul Liive

Online identity verification ensures the person attempting to access a digital service or platform is genuine. It acts as an effective barrier to reduce fraud by preventing unauthorized account access and identifying bad actors who use false or synthetic identities to access services. It has been around for thousands of years, with early forms dating back to King Henry V. Today, verification service documents have evolved, including electronic chips and sophisticated technology, to fight fraud.

Many people carry a government-issued identity document, such as an ID card, state ID, or driver's license. Besides being needed for traveling or as proof of age, you'll often need to verify your identity for various tasks, such as opening bank accounts, starting new jobs, or purchasing a property. Identity verification is a crucial element for businesses as part of their Know-Your-Customer (KYC), Anti-Money Laundering (AML) compliance, age verification, and fraud prevention strategies. But how do your customers/users prove their identity online without being physically present? This is where identity verification solutions from companies like Veriff come in.

Identity verification isn't just about preventing identity fraud; it's about building trust with customers, ensuring regulatory compliance, and streamlining operations to reduce costs. By investing in robust identity verification, businesses can be sure they are onboarding genuine customers and enhancing customer satisfaction, driving profitable growth.

Key business benefits of Veriff´s IDV solutions include:

- Reduce operational costs: Automated verification processes lower manual review costs and improve efficiency. With Veriff only pay for actual verification sessions, not for retry attempts.

- Increase customer trust: A strong IDV solution builds credibility and reduces churn by enhancing customer trust.

- Enhance customer experience and reduce abandonment: customers can now verify their identity without visiting a branch. This convenience offers a smoother experience, allowing verification from anywhere, anytime, on a mobile device or computer.

- Onboard users globally: Veriff’s extensive document coverage supports more than 12,000 documents in Latin, Cyrillic, and Arabic scripts.

A smooth, efficient identity verification process is vital for fraud prevention or onboarding. Long verification times or complex procedures can lead to customer abandonment. A strong IDV solution streamlines verification, reducing onboarding time and effectively preventing fraud.

Operational advantages:

- Speed up onboarding: delivering an average verification response in 6 seconds, reducing friction and abandonment rates.

- Optimize fraud prevention: IDV solutions identify suspicious behaviors, securing legitimate customer passage.

- Enhance customer experience: Seamless identity verification improves the journey, increasing satisfaction and loyalty.

In a world where data breaches and fraud are becoming increasingly sophisticated, your identity verification solution must be effective, scalable, and secure. As the head of IT or security, ensuring the IDV solution integrates seamlessly and protects against threats without compromising performance is key.

Technical highlights:

- Flexibility: Configurable flows and decision engine.

- Scalability: Whether verifying hundreds or millions, our systems scale while maintaining performance and reliability.

- Security-first approach: Built with cutting-edge encryption and fraud detection technologies, our IDV solutions offer industry-leading security against evolving threats.

What business problem did Veriff solve for Webull?

Given the sheer volume of transactions and the levels of finance involved, fraud is a significant danger in the trading and brokerage space.

Trading and brokerage firms must also comply with a wide range of regulations - with legislation varying greatly from region to region. Failure to do so can have serious legal consequences, hurting businesses on several levels.

All of this is why Webull looked to Veriff to help mitigate fraud on their platform using IDV.

“Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed,” explained Webull Chief Risk Officer, Brendan Fuller.

“Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed.”

How can Veriff help your business?

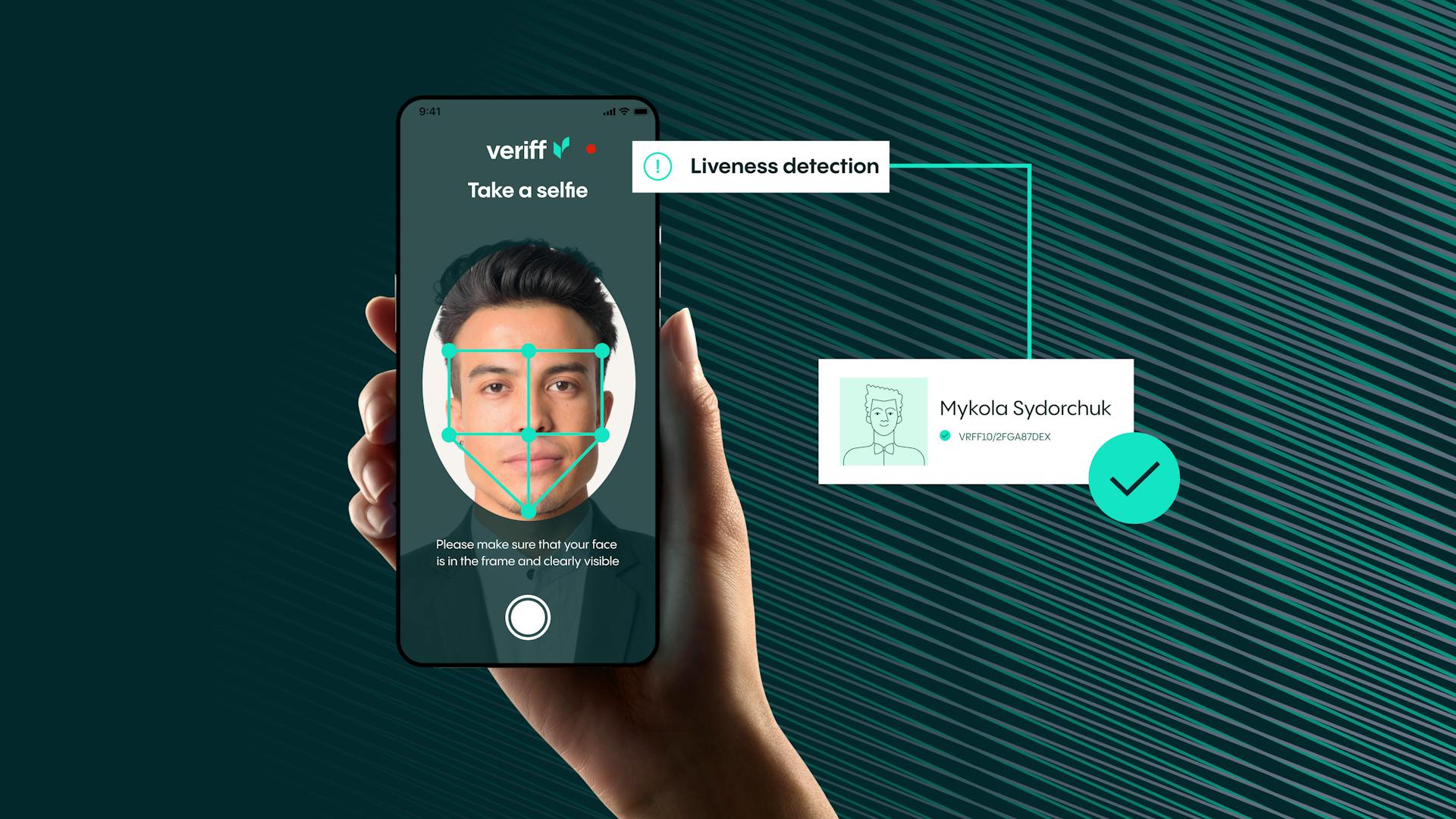

Veriff’s proven technology securely verifies users across the full customer journey - from onboarding to authentication and account recovery. As bad actors evolve their methods and become more sophisticated, businesses must adopt advanced technology to combat fraud. Veriff offers powerful solutions like online identity verification and biometric authentication to ensure secure user verification. These tools utilize facial biometrics and machine learning to detect fraud, secure customer accounts, and provide rapid verification. Veriff's Fraud Protect and Fraud Intelligence products offer enhanced insights and protection strategies to safeguard organizations and customers.

Veriff’s Identity and Document Verification solution combines AI-powered automation with reinforced learning from human feedback, and if required, manual validation. With support for more than 12,000 document specimens from more than 230 countries and territories, we offer speed, convenience, and reduced friction to convert more users, mitigate fraud, and comply with regulations.

How does document verification function?

Veriff guides the user through the entire process with real-time feedback and automatically identifies the document type, so the user doesn't have to manually enter data. This makes the process quicker and minimizes typing errors.

- Capture a photo of your ID (driver’s license, passport, or government-issued ID card) using your webcam or smartphone.

- Take a quick selfie with the same device.

- Get a decision

- Onboard your customer

These steps ensure swift verification. Our guidance ensures it's done right on the first attempt, with decisions delivered within seconds. Verification not only protects against fraud, but also fosters trust in online interactions, where legitimacy is paramount for safe and reliable exchanges. By confirming the authenticity of users and transactions, verification processes help create a more secure digital environment, building confidence among participants and encouraging more open and honest communication.

Full Auto & Hybrid

We understand that every business has its priorities when it comes to identity verification. That’s why we offer two solutions tailored to your needs:

- Full Auto: Our fully automated, AI-driven solution is ideal for businesses that prioritize speed, high conversion rates, and cost-efficiency. With 6-second verification, good accuracy, and excellent conversion, you can ensure a seamless experience for your customers.

- Hybrid: For businesses seeking a balance between speed and maximum accuracy, our Hybrid solution combines automation with the reassurance of trained expert verification specialists. You'll benefit from enhanced fraud prevention, fast verification response times, and the added confidence of human oversight.

In conclusion, implementing digital identity verification is not just a security measure—it's a strategic advantage. By preventing fraud, ensuring regulatory compliance, and fostering customer trust, businesses can protect their reputation and create seamless, secure experiences for their users. As fraud becomes more sophisticated, investing in reliable IDV solutions is essential for staying ahead and safeguarding both your business and customers in today’s digital world. Embrace the power of digital identity verification to build trust and strengthen your business for the future.

Explore more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms