Unveiling the threat: A deep dive into synthetic fraud and document tampering

Learn about the dangers of synthetic fraud and document tampering and how Veriff protects businesses and customers from fraudsters.

Ashley Nelson

Don't miss the chance to explore the latest trends and gain financial advice and actionable insights essential for combating fraud and protecting your business for financial inclusion. Download our Identity Fraud Report 2024 today

-

Synthetic fraud is one of the fastest-growing financial crimes that fintech startups are fighting against in the United States.

Synthetic identities are created by combining real information, such as real social security numbers, and fictitious information, such as false names or addresses. Fraudsters around the globe are defrauding institutions by creating synthetic identities that act like legitimate accounts and can often be missed by legacy fraud detection systems.

There are several obstacles to stopping this kind of fraud — the biggest issue is that fraudsters will “piggyback” onto an actual account with a real user. Oftentimes, bad actors will make small financial moves that could potentially go undetected and then eventually use the stolen social security number to defraud the real user out of large sums of money.

Document tampering is exactly what it sounds like — it’s a process where the physical properties of an official document are altered. This could include erasure, alteration, or substitution.

How we detect document tampering

With over 9,500 government documents in our database, Veriff can verify documents nearly anywhere in the world. Our AI-powered technology is able to detect whether a government-issued identity document has certain correct features that could detect a counterfeit or altered document.

For example, the following are some of the more prominent parts of IDs that we analyze to catch fakes:

- Security features

- Material integrity

- Portrait photo inconsistencies

- Data cross-referencing

- Format validation

- Data dependencies

- Font detection

- Handwriting validation

- And more

Our AI relies on an in-house trained Machine Learning model that detects and matches the presented document in the session with the specimen in our database. When a document is fake or tampered with, the session is declined.

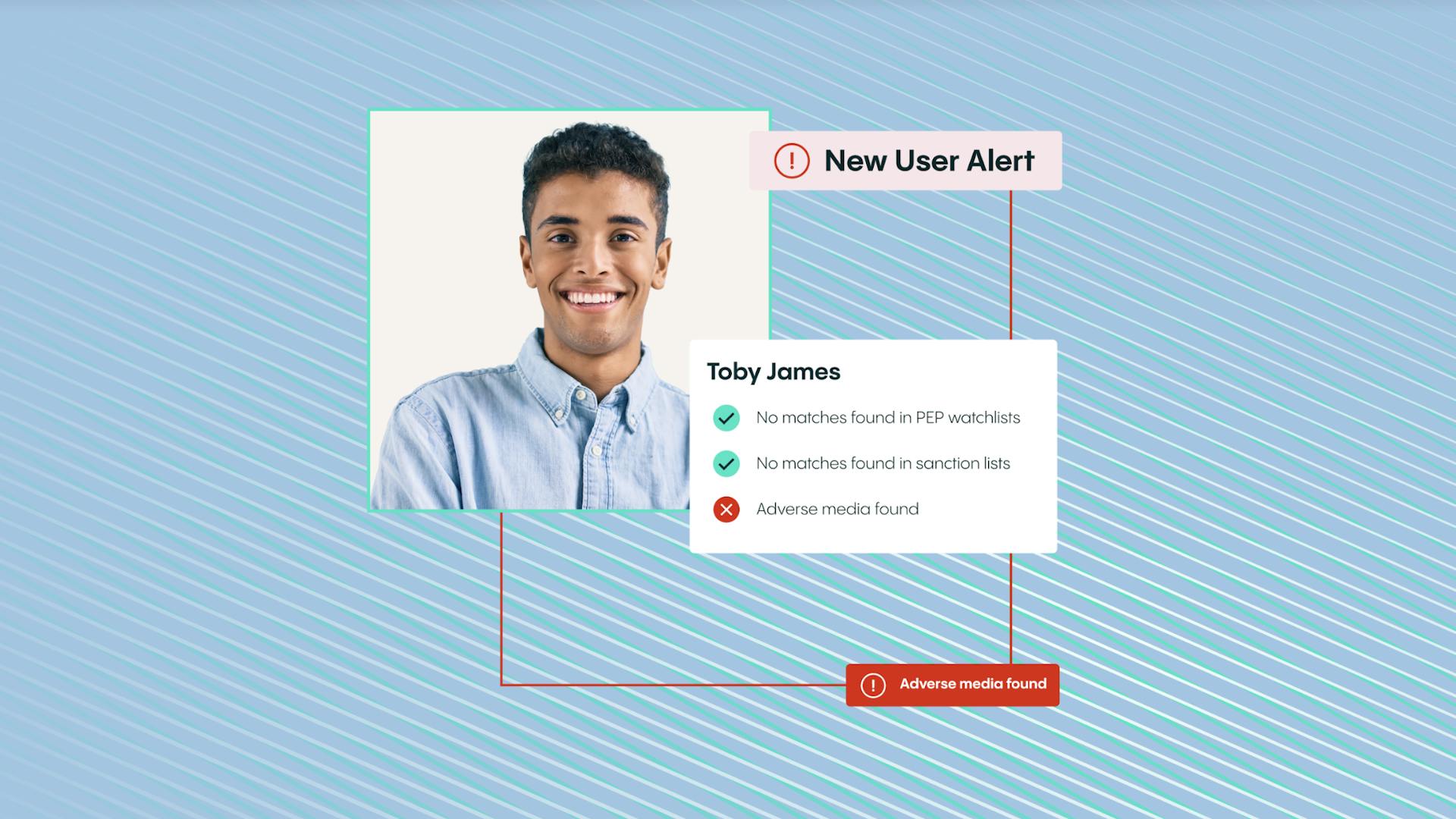

How we can detect synthetic fraud

Veriff uses a multi-prong solution to prevent synthetic fraud. We use device and network fingerprinting, which allows Veriff to apply behavioral analytics to catch fraud.

Also, crosslinking takes behavioral analytics further. Veriff groups verification sessions together and points out risk factors based on user behavior that may seem abnormal and provides that data to our clients. Crosslinking analyzes the person, network, and more.

Additionally, velocity abuse prevents the same person, device, or document (depending on the configuration of the decision engine) from opening multiple accounts, which is common in financial services.

What Does Veriff Do?

Veriff is a market leader in identity verification in KYC services. Our technology leverages more than 1,000 data points to give transparent responses and provide security and trust for businesses. While our competitors have focused on document data extraction, Veriff offers the most accurate online identity verification service. Clients of Veriff, including banking platforms, are frictionlessly onboarding genuine customers - while maintaining KYC compliance and fighting fraud. Digital-only banks have always made security one of their main priorities and as such, have adopted much more innovative and technologically secure protocols than many traditional banks.

We leverage device, network, document, video, biometric and behavioral information to properly utilize speed, accuracy, and fraud prevention in the verification process.