Why Neobanks Don’t Need to Sacrifice UX to Fight Fraud and Stay Compliant

As a 100% virtual entity, a stellar user experience is your key tool to engender trust in your brand and attract and keep customers.

Chris Hooper

Traditional banks have received criticism for an outdated approach to user experiences, from setting up bank check-in and savings accounts using Knowledge-Based Authentication (KBA) to visiting a physical branch to access a range of banking services. In an increasingly competitive financial product services market, customer acquisition remains a key priority, creating an opportunity for challenger banks to grow worldwide. This form of digital banking promises that customers can partner with banks and have a better user experience, from ordering new debit & credit cards in just a few swipes to accessing online banking with bank apps in seconds. However, for neobanks, the desire for good users clashes with the reality of bad actors who look to open fake accounts plus commit acts such as payment fraud and account takeover in bank charters. As such, fighting identity theft in neobanks entails recognizing suspicious activity, prioritizing detection and prevention, and meeting compliance.

Being a 100% virtual entity, neobanks offer key advantages over traditional financial technology and institutions. Removing bricks-and-mortar branches from the equation significantly lowers overheads, making it possible to offer more favorable terms. Meanwhile, freedom from the shackles of legacy infrastructure and established thinking makes it possible to be far more nimble at offering customer-centric experiences. As evidence of this, Capgemini’s World Retail Banking Report 2022 found that 75% of customers surveyed were attracted to FinTech’s fast, cost-effective, and easy-to-use services.

Addressing the trust disadvantage

However, one crucial factor that puts neobanks work at a disadvantage is the trust engendered by face-to-face customer support with customers that their more traditional competitors enjoy. Trust is one of the key pillars of mobile banking, and its ability to drive engagement and increase loyalty directly impacts your bottom line. Previous Capgemini research found that trust outranked price for customers’ choice of bank, underlining the importance of the issue. So, without recourse to direct interpersonal relationships, how can you bridge the trust gap?

To bridge the trust gap, you need to create the kind of seamless online user experience that makes customers feel as supported as if they had a real person ‘holding their hand’.

User Experience: The key to unlocking brand trust

As a neobank, your user interface essentially is your brand. That makes effective design a vital tool to help build your relationship with a new client. However, to paraphrase the great Steve Jobs, design isn’t just about look and feel, it’s about how something works.

To bridge the trust gap, you need to create the kind of seamless online user experience that makes customers feel as supported as if they had a real person ‘holding their hand’. This is particularly important during the onboarding process, when prospective customers are getting their first impression of interacting with your brand. A confusing and complicated user flow or a frustrating identity verification process could be enough to turn a potential new customer into a lost opportunity and a negative review.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Better onboarding through technology

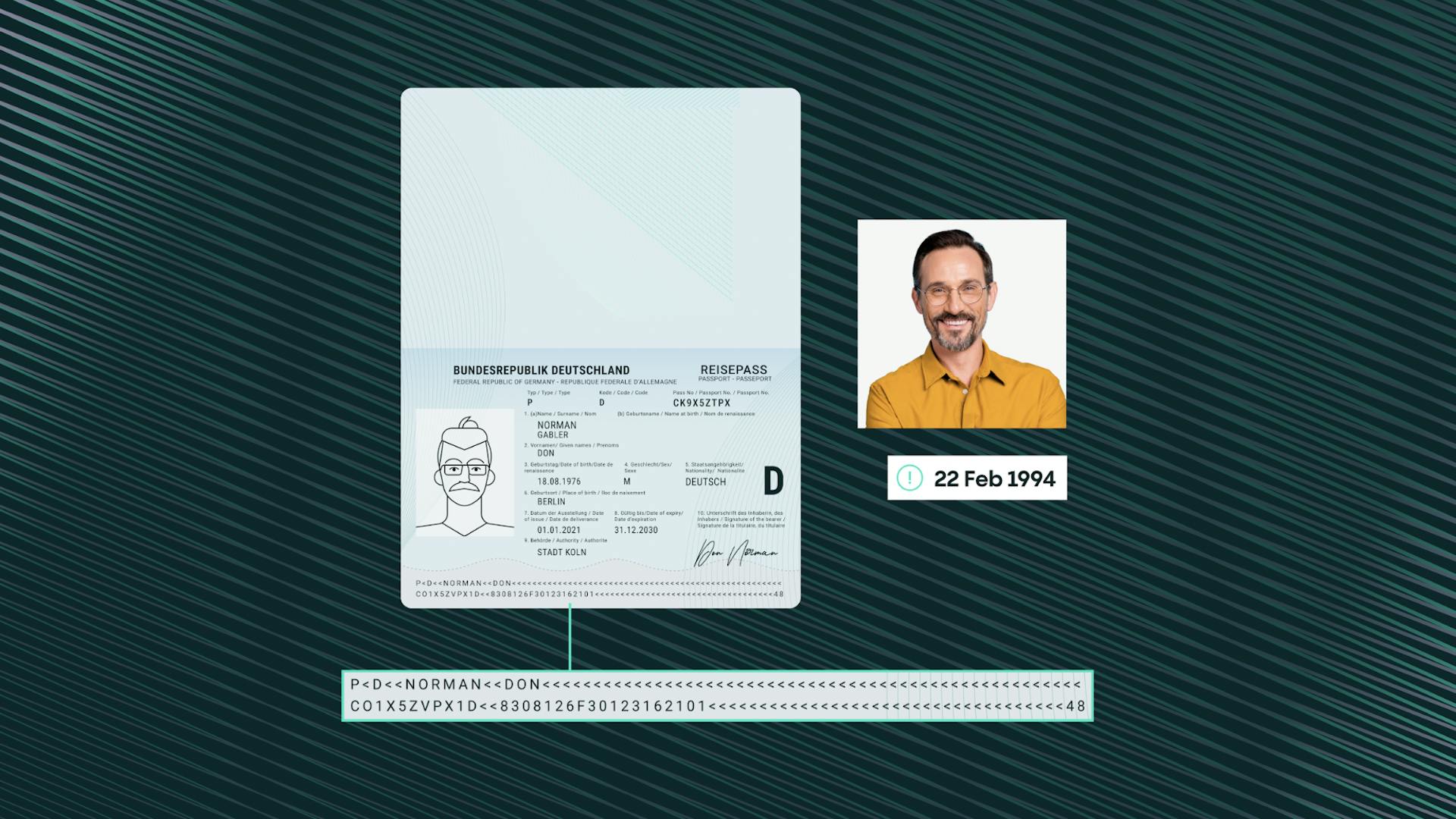

Fortunately, the latest account onboarding systems use sophisticated AI to support customers during the account onboarding process, turning a potential barrier to conversion into a positive engagement tool. For example, Veriff’s Assisted Image Capture technology provides real-time feedback to users that makes sure they get verified on the first try. Verification happens within six seconds on average, moving users through the process quickly and getting them interacting with your products and services.

Veriff also uses a diversified dataset to train facial recognition models so that face comparison accuracy is the same for any ethnicity or document origin. This feature has been invaluable to NALA, a Tanzanian personal finance app focused on addressing the hidden barriers that prevent the African community from accessing traditional financial services and is already used by over 250,000 people.

These and similar innovations can contribute to a seamless onboarding experience that ensures your new clients start their journey with you engaged and receptive to the full range of mobile banking solutions you offer.