Unveiling the power of fraud detection software: Safeguard your business in the digital era

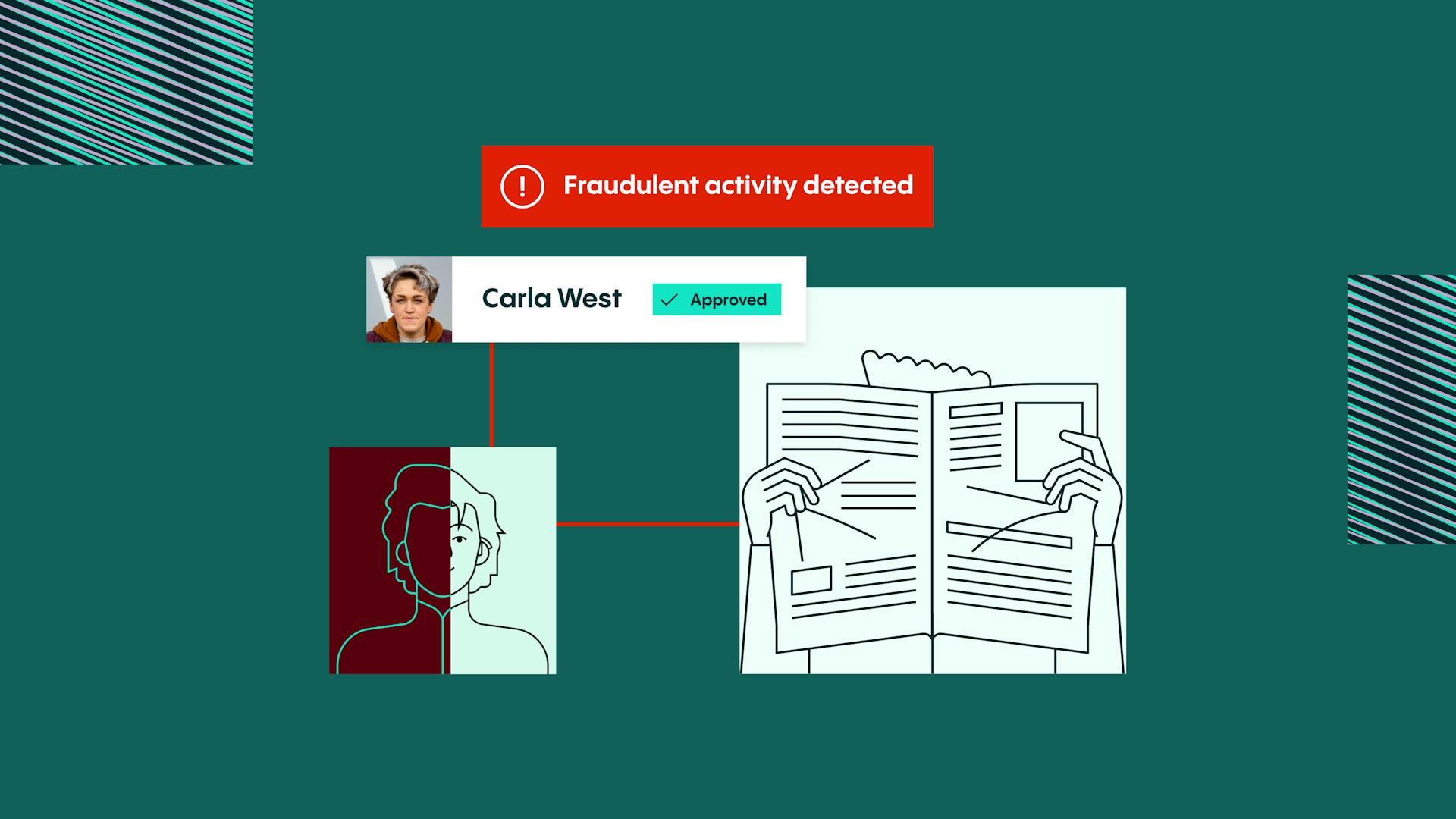

Step into the digital fortress of fraud prevention! In today's cyber battlefield, safeguarding your business is non-negotiable. With cybercriminals crafting ever more sophisticated schemes, online fraud is a global menace.

Chris Hooper

In today’s digital landscape, it has never been more important to secure your business against fraud. Criminals are increasingly sophisticated, evolving their tactics and honing their techniques. According to Europol Spotlight Report, online fraud schemes pose a significant criminal threat within the EU and globally, as online fraudsters generate billions in illegal profits annually, causing harm to individuals, businesses, and public entities.

However,. with advanced technologies like identity verification software (IDV), you can stay ahead of the fraudsters.

The growing danger is clear to see. Veriff’s Identity Fraud Report 2024 found a 20% rise in overall fraud year-on-year from the previous report in 2023. Of the verification attempts we processed over the course of 2023, a worrying 6% were fraudulent.

So, how can you build your defenses against online criminals? Fraud detection software in IDV and beyond provides a crucial advantage.

1. The threat from modern fraudsters

Fraud detection tools are vital for stopping fraudulent activity from taking place. But how could such fraudsters target your business and its customers?

There are numerous approaches fraudsters use to gain access to your business using false or manipulated details or pretending to be a genuine customer, which could include:

- Stealing or manipulating someone’s genuine identity

- Producing fake ID cards

- Obtaining documents like a passport or a driving license in someone else’s name

- Deceiving a genuine user into performing an IDV session

- Conducting ‘man-in-the-middle’ attacks, perhaps through criminal efforts like tech support scams

- Take over someone’s account using their password

- Use phishing or smishing messages

2. Fighting back: fraud detection software

To protect your business against such activity, fraud detection software is key, fortifying your business and protecting your customers. Cutting-edge solutions can thwart criminals, preventing them from infiltrating your business and assets.

What’s more, such tools can help build your reputation for security, instilling confidence in your business and helping to fuel future growth.

So how does it work? Let’s look at IDV, a vital form of fraud detection software.

3. IDV and onboarding

As the name suggests, IDV software is used to check and confirm a person’s identity. In doing so, it can detect fakes and documents that have been tampered with.

How does this work in practice? To verify the identity documents of real people, Veriff’s IDV solution asks the user to take a picture of their identity document. The solution automatically detects whether it’s a driver’s license, passport, residence permit, or standard ID. It assists the user through the process, making the experience seamless. The user’s ID is then verified, and their selfie is checked against the portraitprotrait image from the identity document for likeness and liveness.

This identity verification solution can reach a decision in around six seconds, meaning users enjoy a swift, secure, and minimal friction experience.

4. Verifying the identity of returning users

On top of this, fraud detection tools can also be used to verify the identity of a returning customer. Such fraud prevention tools use facial biometric analysis to validate that a returning user is exactly who they’re claiming to be. In doing so, these tools use a selfie-based biometric authentication that’s far more secure than using a password or one-time passcode.

5. Case study: Deel

Deel is the leading payroll and compliance platform for international businesses. With more than 4,500 organizations using the platform in over 150 countries, it partnered with Veriff to ensure the highest level of security against fraud.

The partnership adds an extra layer of safety and security to Deel’s online platform, meaning organizations can now quickly, easily, and securely verify the identity of employees or contractors as part of a hassle-free onboarding process. Since Deel processes payments, Veriff also helps it meet know your customer (KYC) requirements, a key element of fraud detection.

“Identity verification is critical, especially when providing a reliable and secure experience for our customers online,” said Dan Westgarth, COO at Deel. “Veriff's ongoing commitment to providing the highest quality IDV makes the partnership one we're excited for, especially as we continue to offer more robust and complex offerings.”

6. Challenges of fraud detection softwares

There are plenty of fraud detection software options on the market. However, they face a range of challenges. You must ensure your solution is fit for purpose and that real-time anomaly detection is a given, not an optional extra.

What are the potential obstacles your software tools must handle?

- False positives: These occur when genuine user sessions are flagged as fraudulent, leading to unnecessary investigation or rejection of valid sessions. High false positive rates can lead to customer dissatisfaction and increased operational costs

- False negatives: Conversely, false negatives occur when fraudulent activities go undetected by the software, allowing fraudsters them to proceed unchecked. This can result in financial losses and reputational damage

- User experience: Although essential for safeguarding businesses and their customers, fraud prevention measures frequently result in a less-than-optimal customer experience. While strong controls can effectively stop fraudulent activities, they can also create difficulties for legitimate users who are trying to access services or platforms. Achieving the appropriate equilibrium between preventing fraud and ensuring a positive customer journey remains a persistent challenge for numerous enterprises.

- Complexity: Fraudsters continually evolve their tactics, making fraud patterns increasingly complex and difficult to detect. Fraud detection software may struggle to keep pace with these changes, leading to gaps in detection capabilities

- Data quality: The effectiveness of fraud detection software relies heavily on the quality of the data it analyzes. Incomplete, inaccurate, or outdated data can lead to erroneous conclusions and missed fraud signals

- Overreliance on rules: Many fraud detection systems operate based on predefined rules or thresholds. While this approach can be effective in capturing known fraud patterns, it may struggle to detect novel or sophisticated fraud schemes that don’t fit within the rules

- Adversarial attacks: Fraudsters may actively seek to circumvent detection systems by studying their algorithms and exploiting their weaknesses. This can lead to adversarial attacks designed to evade detection, undermining the effectiveness of the software

- Privacy concerns: Fraud detection software often requires access to sensitive data related to the user, thier device, the nework they are using, etc. to effectively identify fraudulent activities. However, collecting and analyzing such data can raise privacy concerns

7. Key considerations for a fraud detection platform

With the right fraud detection software, you can address these challenges and detect suspicious activity in a secure and seamless manner. The right solution should be adaptable, advanced, and built to respect user privacy while ensuring their security.

So, what exactly should it look like?

- The ideal IDV solution should have built-in fraud detection capabilities prioritizing security. However, it shouldn’t sacrifice speed, ease of use, and accuracy.

- It’s vital to build security in the long term by sharing insights throughout the organization. For example, Veriff’s Fraud Intelligence platform produces risk insights and intelligence to help inform your decisions, offering risk scoring tools to enhance protection

- Solutions that automate identity verification processes, provide real-time feedback, and maintain high accuracy rates are instrumental in ensuring seamless user experiences and robust security measures.

- Solution should involve partnering with a vendor with in-depth knowledge in fraud mitigation, a comprehensive understanding of global identity documents, and a commitment to continuously enhancing their fraud detection capabilities to proactively address evolving fraud trends and accurately identify and flag suspicious activities.

8. Empower your fraud prevention efforts

Arm your business with the right fraud detection platform to combat evolving threats and safeguard your assets. Schedule a consultation with Veriff today to explore how our advanced fraud detection solutions help businesses keep up with the ever-changing threat.

Download our Identity Fraud Report 2024 now to access comprehensive insights and equip your business with the tools needed to combat fraud effectively.

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms