US data privacy laws: Key insights for financial services

As U.S. privacy laws like CCPA and VCDPA evolve, is your financial institution ready? Compliance isn’t just a challenge—it’s an opportunity to build trust and loyalty. Discover how to protect data, empower clients, and lead in a privacy-first world.

Margot Arnus

Introduction

As U.S. data privacy laws for financial services tighten, are you ready to make compliance a competitive edge? Financial institutions face challenges with federal (GLBA, FCRA) and state (CCPA, VCDPA) laws, urging them to enhance their privacy frameworks. It’s about protecting personal financial and consumer data, empowering clients, and building trust. This article explores strategies for staying compliant and strengthening customer loyalty in a privacy-focused world. Ensuring that financial data reporting is correct is crucial for compliance and protecting consumer rights. Don’t just comply—lead the way.

Why privacy, and why now?

Privacy regulations are rapidly evolving across the United States, exposing businesses to a myriad of compliance, operational, and financial risks. Over recent decades, federal laws and state laws have emerged to shield individuals’ personal information from exploitation.

Privacy regulations are coming into force across the United States throughout 2025 and beyond, and these regulatory changes expose organizations to numerous compliance, operational, and financial risks. Over the last few decades, a wave of privacy legislation worldwide has been building, as individuals and governments have taken steps to safeguard their sensitive data and private information in an increasingly digital world. The cost of identity theft, the prevalence of data breach(es), children’s online privacy, consumer requests, and an increased awareness of how private information can be exploited, sold, and stolen have driven national and international regulatory scrutiny into the data collection, data safeguards, and data processes that organizations (including government agencies) have established around individuals’ private information. The Gramm-Leach-Bliley Act (GLBA) Privacy Rule requires financial institutions to disclose their data-sharing practices and set up controls to protect consumer privacy. The Fair Credit Reporting Act (FCRA) ensures accuracy in credit data handling. Still, these federal laws address only very specific aspects of personal data processing. Without a unifying federal privacy law like the American Data Privacy and Protection Act (ADPPA) bill tried to introduce, individual states are leading the charge with tailored privacy frameworks.

"Today, states have identified additional areas of trade that require privacy regulation, and without a unifying federal law like the ADPPA bill introduced, they have taken steps to introduce state-level privacy bills."

Key areas of privacy class action

Privacy class action lawsuits remain a significant and growing risk for businesses operating in the United States.

Organizations risk exposure to class actions related to:

- Unauthorized access and misuse of biometric data (e.g., BIPA)

- Unauthorized text communications (TCPA)

- Call recording without consent (CIPA)

- Tracking video consumption (VPPA)

Further, tools like cookies and chatbots have drawn scrutiny under state privacy laws, especially when consumer data is leaked due to poor security measures.

Digital surveillance practices—such as the use of cookies, pixels, chatbots, and “session replay” tools—are especially scrutinized by regulators and plaintiffs alike. Under the CCPA, for example, companies may face private lawsuits if a data breach occurs due to insufficient security measures. The consumers can seek damages up to USD 750 per incident.

The finance sector remains one of the top industries to be targeted under CCPA claims. This evolving litigation landscape reinforces the importance of strict compliance with privacy regulations. Businesses that fail to adopt proactive data protection measures not only risk financial penalties but also significant reputational harm.

Key provisions of state-specific privacy laws in financial services

- Data protection: Financial services must secure customer information and personal data using encryption and safeguards that prevent unauthorized access. This is a requirement for financial institutions under GLBA, and also emphasized by many state laws. Veriff’s identity verification solutions support compliance, protect personal information, and help to maintain audit trails—key in case of regulator inquiries.

- Consumer rights: Modern privacy laws grant consumers rights to access, correct, or delete their personal and financial information. States like Virginia, Utah, and Colorado require clear privacy notices, opt-outs for marketing, and detailed vendor contracts. The Texas Data Privacy and Security Act (TDPSA), effective July 2024, impacts contracts between financial services and third-party service providers.

- Opt-out mechanisms: Clear, easy opt-outs for the use of consumer data in marketing or analytics are now a must. Companies must honor users’ choices and provide controls that reflect the protection act intent of the law.

The importance of compliance for financial institutions

Compliance with state-specific privacy laws is not just a regulatory issue—it’s a vital part of the value proposition for financial services companies. Financial institutions have the opportunity to differentiate themselves from the competition by demonstrating their commitment to protecting client data and protecting consumers. Non-compliance, on the other hand, can lead to severe consequences, such as fines, reputational damage, and loss of trust.

Non-compliance with state privacy mandates has a direct financial impact on companies via regulatory fines calculated per violation. For example, Blackbaud, Inc., in a stipulated judgment, agreed to pay $6.75 million to resolve allegations that it violated consumer protection and privacy laws.

By embedding data privacy into their operations, financial services businesses can build client loyalty and enhance their reputation as leaders in data protection. When selecting a service provider, it’s important that they share your commitment and values.

🎥 Watch this explainer video: What is U.S. data privacy and why does it matter?

This short video breaks down how U.S. data privacy laws are evolving and why financial institutions must act now to stay ahead. It’s a great complement to our comprehensive guide.

The role of Identity Verification in financial compliance

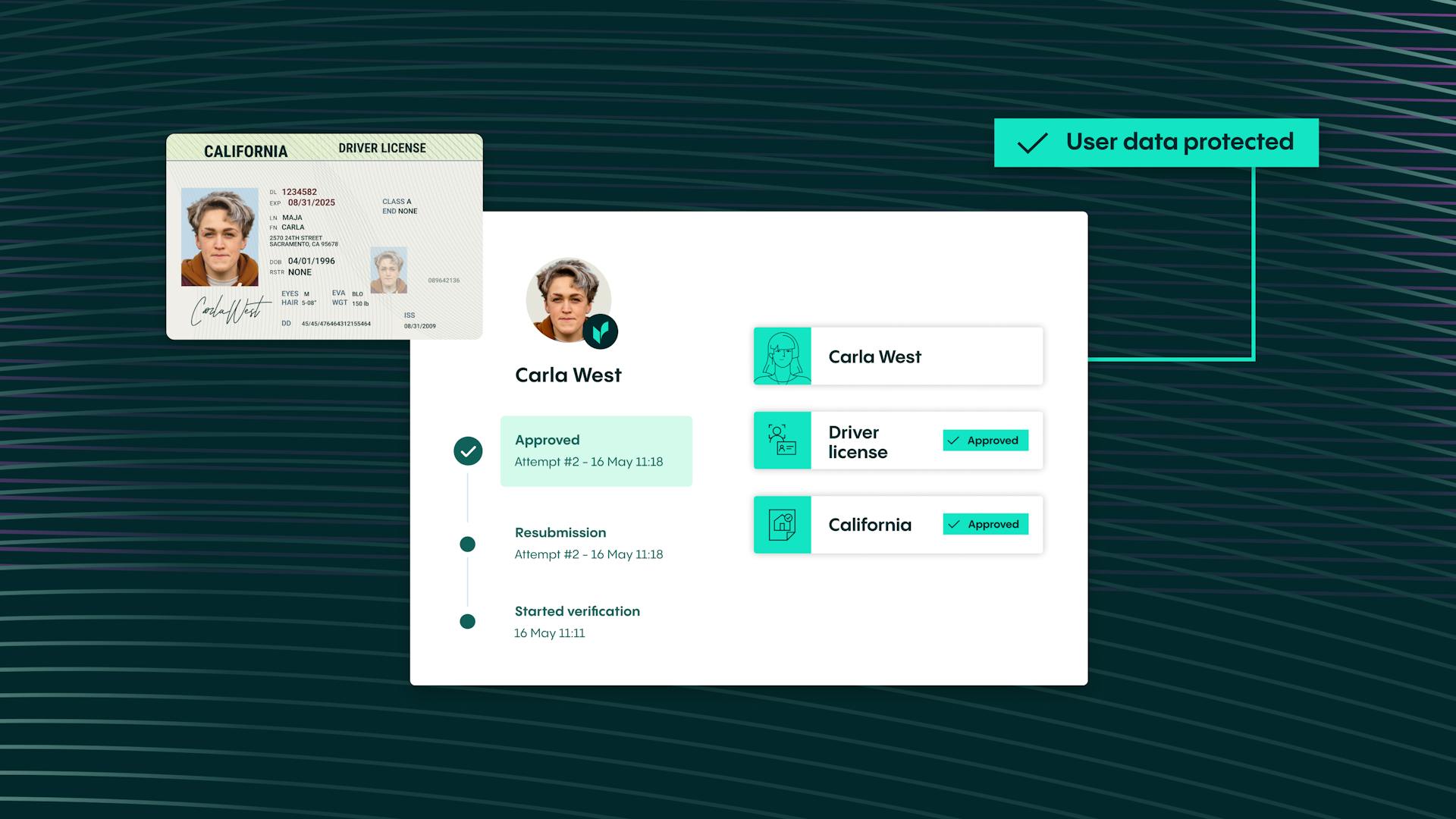

Identity verification is essential in complying with laws that protect consumer rights and guard against unauthorized access. Advanced tools from Veriff help verify identities accurately while preserving personal information integrity and privacy.

Such tools automate checks, create audit logs, and assist with compliance with both federal laws and state laws, including the Fair Credit Reporting Act (FCRA) and Gramm-Leach-Bliley Act (GLBA).

With increasingly sophisticated cyber threats, accurately verifying a client’s identity is essential, particularly when processing requests for access, deletion, or modification of personal data. Financial institutions must request access to verify identities for data access requests, ensuring that only authorized individuals can view or modify sensitive information. However, the privacy and data protection aspects must also be taken into account. By using advanced identity verification solutions, such as those provided by Veriff, financial institutions can securely confirm identities, mitigating fraud and ensuring compliance with state laws.

These solutions streamline the compliance process by automating identity verification, supporting data protection efforts, and enabling the setting up of audit trails. When it comes to handling such incredibly sensitive data, a competent service provider helps financial institutions to achieve peace of mind. The auditability of these processes ensures that financial institutions can demonstrate compliance in the event of regulatory scrutiny.

Practical tips for financial institutions

Implementing effective security measures is critical for protecting consumer financial information in the United States.

- Stay informed: Track developments in federal and state laws to remain compliant.

- Invest in technology: Use identity verification, encryption, and monitoring tools to protect financial products and services.

- Enhance transparency: Clearly disclose how you handle personal data.

- Train your team: Ensure staff understand how to comply with regulations and handle consumer data responsibly.

- Conduct audits: Regularly assess systems and practices to prevent unauthorized access and demonstrate due diligence.

Future of US data privacy law

The Federal Trade Commission (FTC) is actively proposing new rules to unify the currently fragmented U.S. approach to data privacy. As states continue to pass or propose comprehensive privacy laws (keep in mind that for example Nebraska, New Hampshire and New Jersey state laws just entered into force in January 2025), and federal legislation efforts gain traction, financial institutions must be ready to adapt.

These evolving frameworks are expected to reshape how businesses collect, process, and protect personal information, especially when delivering financial products and services. In particular, organizations handling biometric data or sensitive consumer details will need to ensure proper consent mechanisms and robust safeguards are in place to comply with both state laws and any upcoming federal laws.

Proactively investing in systems implementing privacy by default principles and privacy by design practices now will help organizations remain resilient amid regulatory shifts, reducing legal exposure, protecting consumer data, and strengthening long-term trust and competitiveness.

Conclusion

In conclusion, US privacy laws are complex and multifaceted, with both federal and state regulations playing a critical role in protecting consumer data. Financial institutions must navigate a range of laws and regulations, including the GLBA, FCRA, and CCPA, to ensure they are taking adequate measures to safeguard sensitive financial information. By staying informed about the latest developments in US privacy laws and working with regulatory agencies, businesses can help protect consumer data and maintain trust in the financial system. As the landscape of data privacy continues to evolve, financial institutions need to prioritize compliance and invest in robust security programs to prevent data breaches and protect sensitive information to regulatory frameworks and requirements.

FAQ

1. Why are U.S. states enacting their own data privacy laws?

Without a comprehensive federal law, states are passing laws to protect consumer data and address the growing threat of unauthorized access and data misuse.

2. What challenges do businesses face with varying state privacy laws?

Operating in multiple jurisdictions means tracking and complying with differing protection act requirements—an evolving task demanding a dedicated strategy.

3. How does the U.S. approach differ from the EU’s GDPR?

The U.S. approach is fragmented—relying on a mix of federal sectoral laws like GLBA or HIPAA, and state privacy laws such as the CCPA, whereas the EU’s GDPR is uniform across sectors and borders.

Explore more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms.