Veriff's secure Biometric Authentication solution: Leading the fight against online fraud

Enter Veriff’s Biometric Authentication solution—a game-changer in the fight against fraud. Join us as we delve into how Veriff’s cutting-edge solution is revolutionizing fraud prevention, safeguarding businesses, and ensuring a safer digital experience for all.

Geo Jolly

Listen to full conversation with Geo now!

In this conversation, Geo Jolly, Lead Product Manager at Veriff, examines how AI and facial biometrics authenticate users and combat fraud, including account takeover fraud, where unauthorized access can lead to significant financial damage.

The evolving digital economy brings powerful advantages for online businesses – and new opportunities for fraudsters.

Yet, the threat of online fraud continues to escalate. According to the Veriff Identity Fraud Report 2025, fraudulent activity surged by more than 20% in 2024 alone. Among these cases, impersonation fraud made up a staggering 82%, underscoring the increasing sophistication of cybercriminal tactics. Meanwhile, account takeover incidents grew by 13%, and multi-accounting cases rose by 10% compared to the previous year.

Choosing the right biometric authentication system is crucial for organizations to meet their specific budget and scalability needs.

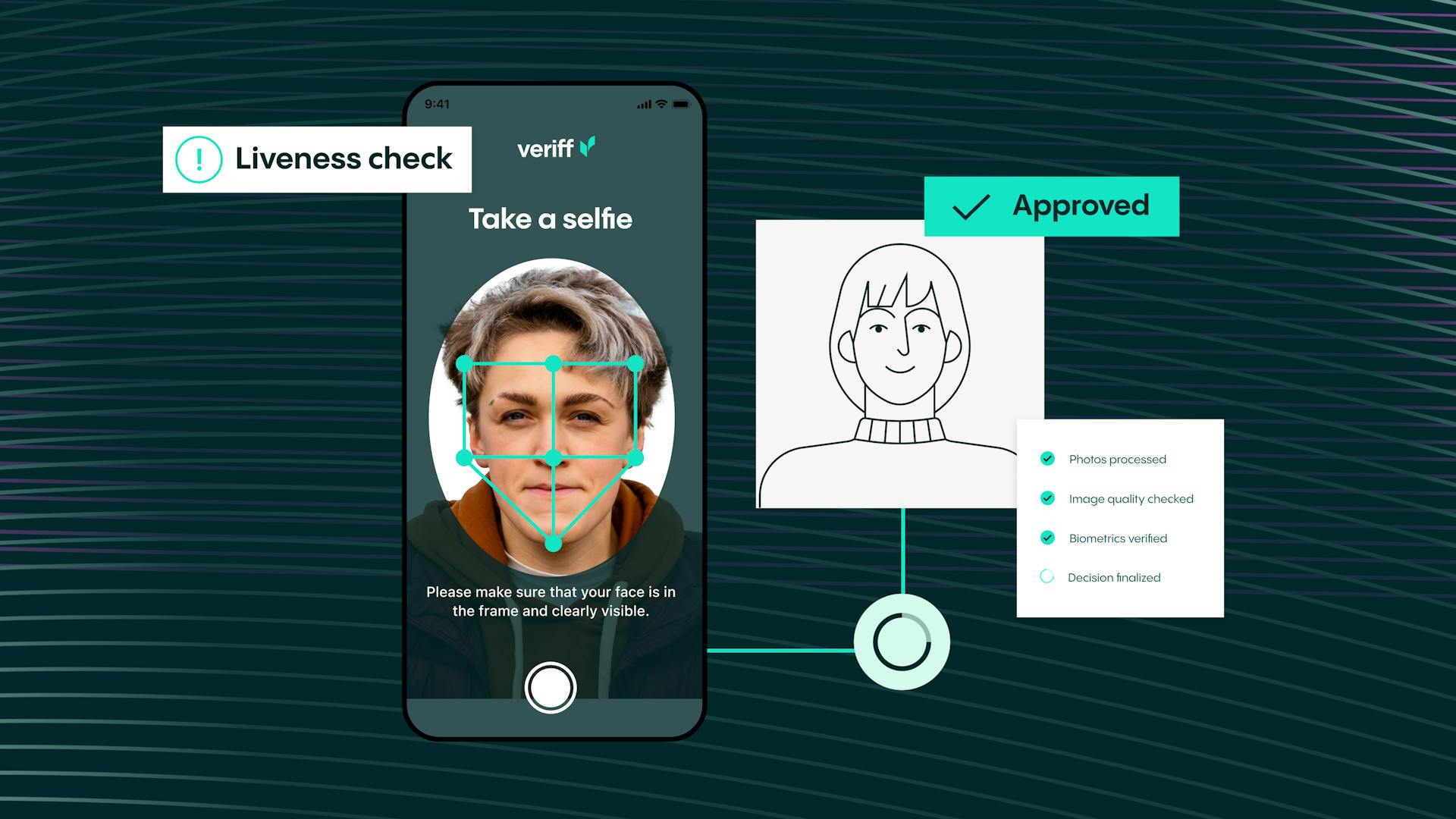

Veriff’s Biometric Authentication solution enables fast, secure, and seamless user verification through a fully automated process, making access to digital services more convenient. The latest update includes enhanced fraud prevention features such as liveness detection and anti-spoofing technology to safeguard against unauthorized access and account takeovers.

“Veriff’s Biometric Authentication solution is critical to the effectiveness of preventative tools in fighting fraud by reducing ATO by 80% - 90% in 2024. The solution has proven mission-critical in helping us stop account takeovers and continues to safeguard us against high-risk activities.”

Introduction to biometric technologies

Biometric technologies are revolutionizing secure authentication by leveraging unique biological characteristics such as fingerprints, facial recognition, and iris recognition to verify a user’s identity. Unlike traditional authentication methods like passwords and PINs, biometric data is incredibly difficult to replicate or steal, making it a more secure option. This advanced biometric technology is employed in a variety of applications, from access control and identity verification to authentication processes, providing a secure and convenient way to identify individuals.

For example, governments and agencies utilize biometric technologies to prevent fraud and ensure the security of national borders. By implementing these methods, they can accurately identify individuals and maintain high security standards. The unique nature of biometric data, such as the intricate patterns in an iris or the distinct features of a face, ensures that each authentication is both precise and reliable. This makes biometric technologies an essential tool in the modern fight against fraud and unauthorized access.

Types of biometric solutions

Biometric solutions come in various forms, each with its own unique characteristics and use cases. Fingerprint recognition is one of the most widely used biometric solutions due to its speed and simplicity. It involves capturing the unique patterns of a person’s fingerprint and matching them against stored data for quick and accurate identification.

Facial recognition, another popular biometric solution, uses advanced algorithms to analyze and match facial features. This method is particularly useful for online services as it can be easily implemented using a camera on a smartphone or computer. Iris recognition, known for its high accuracy, involves scanning the unique patterns of the iris to verify identity. This method is often used in high-security environments due to its precision.

Voice recognition is a convenient biometric solution that uses the unique characteristics of a person’s voice to authenticate their identity. This method is particularly useful in scenarios where hands-free authentication is needed. Biometric solutions are widely used across various industries, including finance, healthcare, and government, to provide secure authentication and prevent fraud. Each type of biometric solution offers distinct advantages, making them suitable for different applications and environments.

Biometric technology benefits

There are many types of biometrics analysis, including analysing a person’s fingerprint, gait, or eyeball, but it is facial biometrics that is most useful to online services. There are a number of reasons for this:

Facial biometrics can be captured by taking a selfie on the user’s camera, laptop, tablet or computer - there is no need for specialist equipment like fingerprint scanners. The user takes a selfie and the biometric analysis compares it to a stored biometric template or government ID to confirm that the user is who they say they are.

Facial biometrics as an authentication method are also far more secure than passwords, for example, because they are much more difficult to steal. They are also more secure than device-based tokens, which assume that a genuine person has their device with them; or one-time passcodes, which assume that the passcode has reached the intended recipient without being intercepted or diverted.

Facial biometrics are also more accurate than other identification methods because there is a higher ability to confirm the human presence in the session and to confirm that the human is the right person in their selfie - something that is not possible when only requiring users to type in a password or shared code.

They also boost the user experience because customers don’t need to remember cumbersome passwords or other login details when it comes to accessing an account.

And they can also save organizations time and money - customers never need to remember their login information, so there’s no need to waste resources on resetting passwords on accounts or assisting customers through account verification or re-verification.

By eliminating the need for passwords, biometric authentication significantly enhances the customer experience, allowing for quick and easy account access.

Security, convenience, and speed

We know that organizations need to securely authenticate users without disrupting the user experience. This matters across the entire customer journey, particularly at critical steps such as account access, undertaking a high-risk activity, or recovering an account.

While biometric authentication offers unparalleled protection, it also provides ease of use, making it a significant advantage for both users and organizations.

With facial biometrics, you can offer secure authentication combined with user-centered authentication and a streamlined experience. You can access seamless identity assurance and enjoy the benefits of adaptive technology and explainable decision-making that is customizable and scalable for your needs.

For companies facing a growing threat of increasingly sophisticated online fraud, being able to verify users instantly, conveniently, and securely, while beating the fraudsters, is a win-win for platforms and users alike.

And that is why Veriff has expanding its product offering with a new-lookBiometric Authentication solution. With improved user experience and accuracy, strengthened security and more seamless identity assurance, Veriff’s solution provides a streamlined authentication process that mainly helps preventing unauthorized access and account takeovers, but can also be utilised for other use cases. The updates come as Veriff continues to see strong adoption of its identity verification (IDV) and biometric authentication solutions to fight increasing online fraud.

Integration with existing systems

Integrating biometric technologies with existing systems is essential for providing a seamless and secure authentication experience. Although the process can be complex, it is crucial for ensuring that biometric solutions work effectively within various platforms. For instance, biometric authentication solutions can be integrated with smartphones and software applications to secure transactions and prevent fraud in the finance industry.

Additionally, biometric technologies can be incorporated into existing security systems, such as access control and surveillance systems, to provide an additional layer of security. Leading providers of biometric technologies, such as Aware and AuthX, specialize in creating solutions that are easy to implement and integrate with existing systems. By doing so, they ensure that businesses can enhance their security measures without disrupting their current operations. This seamless integration is key to maximizing the benefits of biometric authentication solutions.

Key features of Biometric Authentication solution update include:

- Increased conversion – Improved image resolution for better face-matching accuracy and enhanced detail capture in biometric templates.

- Improved fraud detection – Analysis of 30+ risk signals across behavioral, device and network parameters improve accuracy and the ability to combat more sophisticated fraud attempts.

- Deepfake and synthetic media detection – Veriff improved face liveness checks for synthetic and AI-generated media detection.

- User identity-based authentication – another step towards user-centric digital identity to ensure a secure and seamless user experience.

- Actionable insights – With more detailed insights, customers are equipped with specifics about what took place during the authentication journey.

- Compliance with regulatory standards – Ensuring adherence to privacy and security regulations to protect biometric data.

“User authentication can be a cumbersome process, with some fintech customers completing an average of five different authentication sessions, which introduces friction and negatively impacts the experience,” says Hubert Behaghel, Veriff CTO. “We’ve augmented our Biometric Authentication solution to make it more efficient, user-centric and secure. Our solution adapts to individual user behaviors, ensuring authentication for the users themselves rather than just a session. This level of biometric authentication is one step forward on our journey to one reusable digital identity.”

User acceptance and accessibility

User acceptance and accessibility are critical factors in the successful adoption of biometric technologies. For biometric solutions to be widely accepted, they must be user-friendly and convenient, offering a simple and fast authentication process. Users need to feel confident in the security and privacy of their biometric data, which means that these technologies must be designed with the user experience in mind.

For example, push notifications can be used to alert users of authentication attempts, adding an extra layer of security and convenience. Biometric solutions must also be accessible to all users, including those with disabilities, to ensure that everyone can benefit from the enhanced security and convenience they offer. By focusing on user-friendly design and accessibility, biometric technologies can provide a seamless and intuitive authentication process that meets the needs of all users.

Related articles

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms.