The Veriff advantage for trading and brokerage firms

Identity verification (IDV) is now essential for trading and brokerage firms, protecting broker dealers and their customers from money laundering, fraud and other crimes. With Veriff’s AI-powered solution, platforms combine robust security with the highest levels of customer experience.

Fin Murphy

Trading and brokerage platforms are targets for criminal or even terrorist elements, who seek to launder money from their illegal activities or commit various forms of financial or identity-related crimes. The sheer volume of transactions and cash that platforms process, combined with the international nature of the business and the rise of multiple trading options for individuals and organizations, makes it a target for crime.

Veriff has always worked in highly regulated sectors, from gaming to crypto to fintech. We know what it takes to strike the right balance between security and the optimal user experience (UX).

If customers don’t feel safe, you’ll face a serious reputational hit. On the other hand, if the onboarding process is slow and frustrating, customers could take their business elsewhere.

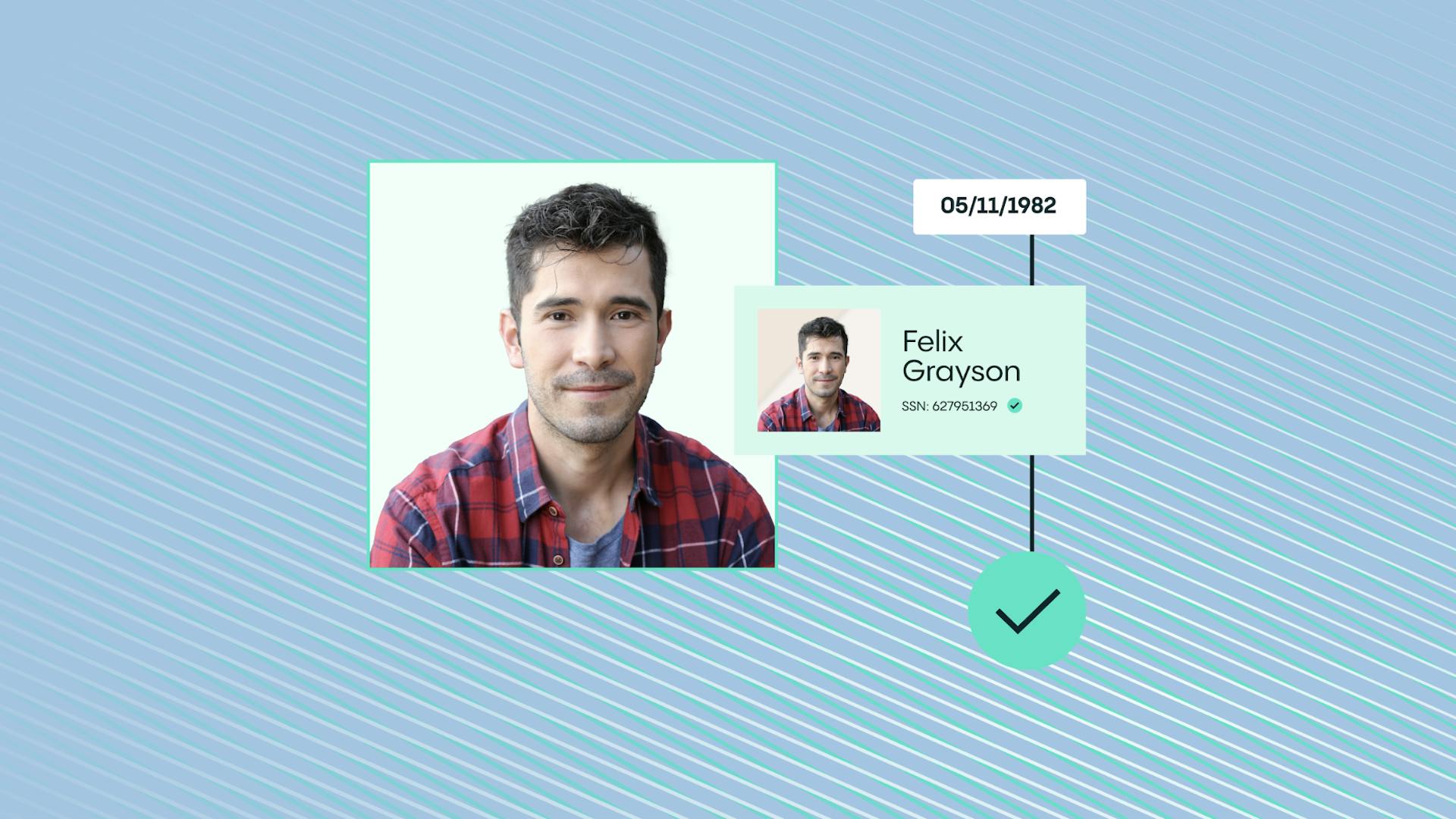

Our approach is based on a three-stage process, which aims to make life as easy as possible for the customer, while providing the highest level of security. First, the customer takes a photo of their ID and a selfie. Next, we verify the document’s authenticity, confirming their liveness and their similarity to the photo. Finally, we return our data and decision to the platform in question.

What goes into this process? We offer four essential advantages:

Unmatched document coverage: Your customer base is international, so your IDV tools must be global in outlook. With more than 12,000 government-issued ID types in our database, we can support onboarding for customers in more than 230 countries and territories and in 48 languages and dialects.

Fast but secure decisions: Our 98% check automation rate means customers pass through in about six seconds.

Simple experience: We provide real-time user feedback through technology like Assisted Image Capture (AIC), guiding customers through the process. This means there are fewer steps involved, with 95% of users going through on the first try.

More conversions: With superior accuracy and an enhanced user experience, you can expect up to 30% more customer conversions.

Our process is inclusive, working across iOS, Android, native software development kits (SDKs) and beyond. We have a dedicated team of specialists from more than 60 countries, able to help resolve queries when a human contribution is necessary, while the final decision uses AI to avoid any potential bias.

Above all, we are adaptable. We offer not just the best security and customer experience – we tailor it to your needs. Through combining security, flexibility and simplicity, trading and brokerage firms can seize the opportunities that IDV can offer.

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms