KYC automation: enhancing customer onboarding

Unlocking the doors to a seamless digital journey begins with client onboarding. Whether welcoming a new customer to a company or introducing a user to a service, the process sets the tone for the relationship ahead. In today's digital landscape, the spotlight shines on digital onboarding—an entirely online experience, untethered from physical branches or premises.

Chris Hooper

1. What is KYC automation and customer onboarding?

Firstly, let’s start with customer onboarding. Customer onboarding is the process of acquiring a new customer to a new company or subscribing a new user to a new service. As the name implies, digital onboarding is a fully digital version of this experience – meaning that it takes place on websites or in an app – but not in a branch or on a premise.

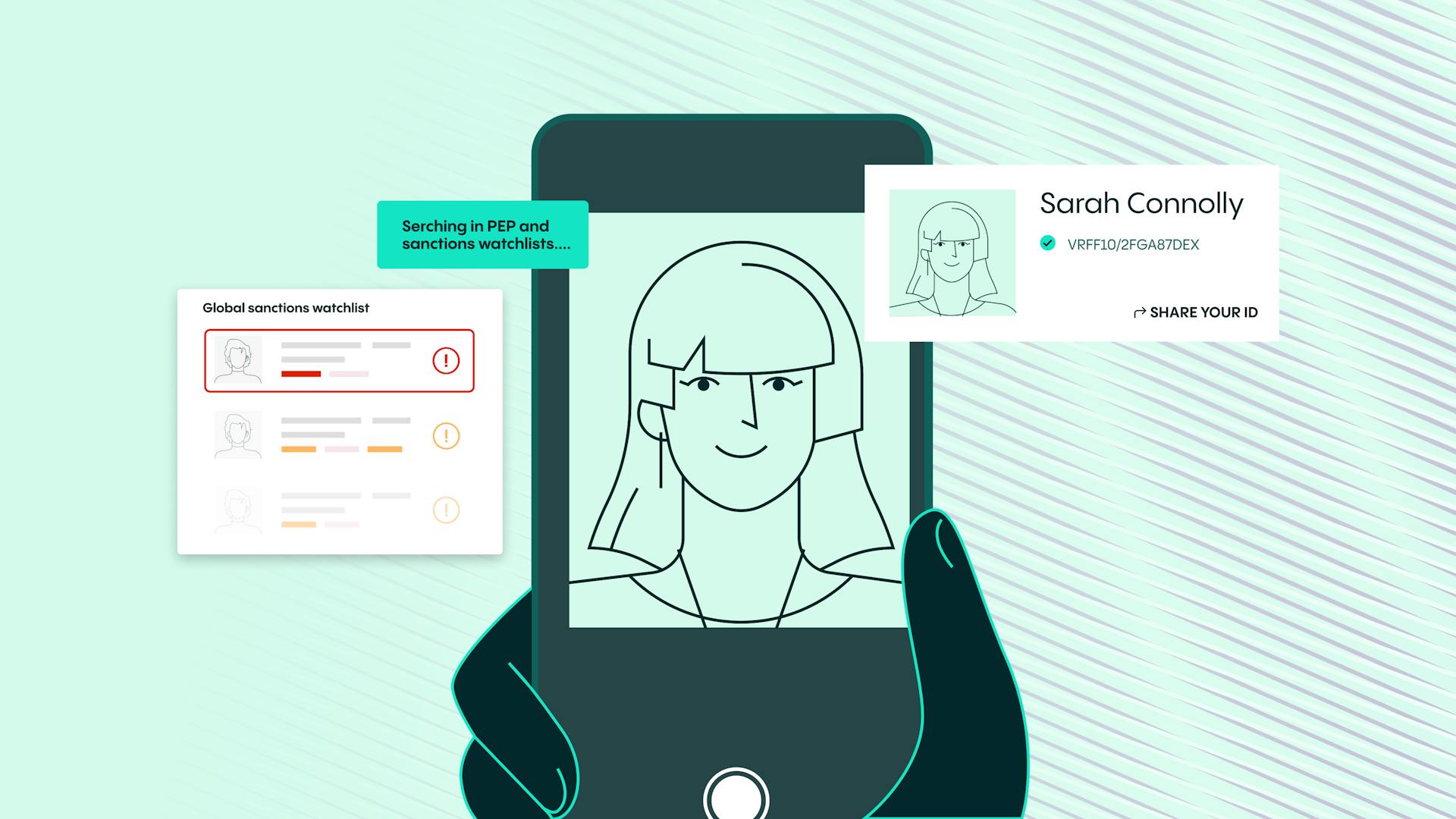

The main purpose of the customer onboarding process is to make sure that the individual in question is really who they say they are. Because of this, a certain level of due diligence is required.

If, for example, the company in question is regulated – like a financial institution would be – then it will have to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This means that advanced identity verification needs to be carried out to verify a customer’s identity and suitability, and to ascertain and fully understand the risks involved with maintaining a business relationship.

KYC automation is, therefore, the use of technology and software tools to streamline and enhance all of these processes.

2. Why is understanding KYC automation important in customer onboarding?

Today, more often than not, manual processes don’t cut it when it comes to creating smooth-sailing onboarding processes – and therefore customer experiences.

Automated onboarding, on the other hand, streamlines and simplifies this necessary journey – all the while allowing your company to see what’s happening every step of the way. This could help create a unified customer experience, boost customer retention, drive product adoption and generally help when it comes to building lasting relationships.

3. How can businesses enhance the effectiveness of KYC automation by emphasizing key customer onboarding strategies?

There’s no shortage of different customer onboarding strategies, and many of these can help boost the effectiveness of KYC automation and KYC solutions. Here are some examples:

Document verification and authentication

As part of the customer KYC procedure, during this phase of digital onboarding, a customer is required to submit identification documents, such as government-issued IDs or utility bills, electronically.

Specialized technologies, such as optical character recognition (OCR), near-field communication (NFC), and barcode scanning, are used to read the identity document details. Machine learning models and AI are then used to verify that these documents are genuine, untampered, and belong to the person claiming to be the holder.

Customer identity verification

Using various identity verification tools like biometric verification, selfie comparison with ID photos, or secret security question prompts, organizations can validate the user’s identity in real-time.

Artificial Intelligence (AI) and Machine Learning (ML)

By automating customer identity verification and fraud detection, AI and ML eliminate time-consuming manual analysis and reduce the risk of human error.

They use algorithms and predictive models to process, learn, and make decisions from stored data, such as customer information, transaction behaviors, and more.

AI-backed systems, for example, mean that customers can upload an ID, take a selfie, and obtain an answer in a very short period of time.

Passive liveness detection

An advancement in biometric technology, passive liveness detection has become a crucial instrument in digital onboarding to combat fraud. This technology ensures that biometric data such as facial features captured during the digital identity verification process comes from a live person rather than a photo or video reproduction, or deepfake.

Image Capture technology

Identity verification can be a sensitive matter, with confusion easily turning to distrust. The right systems, however, can make things simple, providing real-time feedback to customers to help them pass first time. Assisted Image Capture (AIC) technology makes it easy for onboarding customers to get their selfie right on the first try.

5. How does the integration of customer onboarding and KYC automation affect the effectiveness of fraud prevention and risk management?

Automated KYC verification uses advanced tech, for example AI and machine learning, to detect potential fraud and other risks, making it much more effective than manual processes. This in turn results in enhanced security and a reduced likelihood of financial crime.

Become and stay KYC compliant

4. How does effective customer onboarding benefit businesses in terms of compliance and KYC automation?

Today’s consumers and businesses demand robust security measures and savvy onboarding solutions. Anti-fraud mechanisms, such as AI-powered anomaly detection, and encryption, should be part and parcel of onboarding systems.

It is also vital to ensure you know who is entering your platform in order to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This will not only keep fraudsters and other criminals at bay – ensuring you remain on the right side of the law – it will also protect your organization financially as well as your brand value.

However, customers must also be kept front of mind. A lengthy, onerous process, perhaps involving a manual ID check, could drive potential clients into the arms of your competitors. If you get it right, on the other hand, new customers will start off on the right track, viewing your platform in a positive light, with all that means for brand value in the years to come.

Its therefore apparent that by automating KYC procedures, the customer onboarding process will become a much smoother, faster, and more efficient one.

6. How does Veriff's KYC automation enhance both the efficiency and accuracy of the customer onboarding process?

Veriff's KYC automation improves the efficiency and accuracy of customer onboarding by guiding the user through the entire process with real-time feedback. It can even automatically identify the document type. This automates any data entry, creating a quicker process, and minimizing typing errors.

7. Veriff and Easygo/Stake

Easygo is a global software development startup that focuses on disruptive technology within the online gaming sector. The company is renowned for the cutting-edge design of its casino games, crypto platforms, and sportsbooks – all built on Easygo’s “provably fair” algorithms.

Prior to Easygo’s partnership with Veriff, its subsidiary Stake.us carried out manual in-house KYC screening. This process involved an ID verification team, based in Serbia, looking at thousands of individual customer documents and using a point-by-point checklist to determine if they were KYC compliant.

This analogue approach was incredibly labor intensive, costly and caused a huge bottleneck in the customer-onboarding process.

Easygo turned to Veriff to accurately verify the customer age and address, to ensure their customers were legally old enough to gamble online and were resident in those US states where the company could legally operate and achieve regulatory KYC compliance.

Veriff’s platform provided the automated, near-real-time solution Easygo was looking for. It asks customers to take a quick selfie as well as a photo of their government-issued ID using their smartphone or tablet. An AI algorithm checks the selfie for liveness and realness in real time by comparing it to live video taken from the customer’s device with their express permission.

The selfie is then compared to photographs from the customer’s government-issued identity documents, which are also automatically checked and authenticated using AI.

FAQ

1. Why is KYC automation important for streamlining the customer onboarding process?

By extracting and verifying data from documents, and using pre-fill forms, KYC automation plays an integral part when it comes to streamlining the client onboarding process. Friction is reduced – with users making it through identity verification with minimal-step processes and a lack of unnecessary user actions – and checks can be customized to meet your unique needs.

2. Are there any regulatory requirements associated with KYC automation in customer onboarding?

The regulatory requirements associated with KYC automation are the same as those associated with manual KYC processes. These of course vary by jurisdiction and industry, but they generally require businesses to verify customer identity, assess their risk level, and monitor their transactions for potential fraud, money laundering, or terrorist financing activities.

Crucially, KYC automation can help businesses when it comes to complying with these regulations by:

- Ensuring that customer data is accurate and up to date

- Ensuring that risk assessments are conducted consistently and accurately

- Providing real-time updates on changing regulations

- Helping businesses identify potential risks and fraud quickly and accurately

- Streamlining the KYC process, helping businesses reduce the risk of errors and inconsistencies and ensuring that all customers are treated fairly and equitably.