Digital onboarding for financial services: key insights

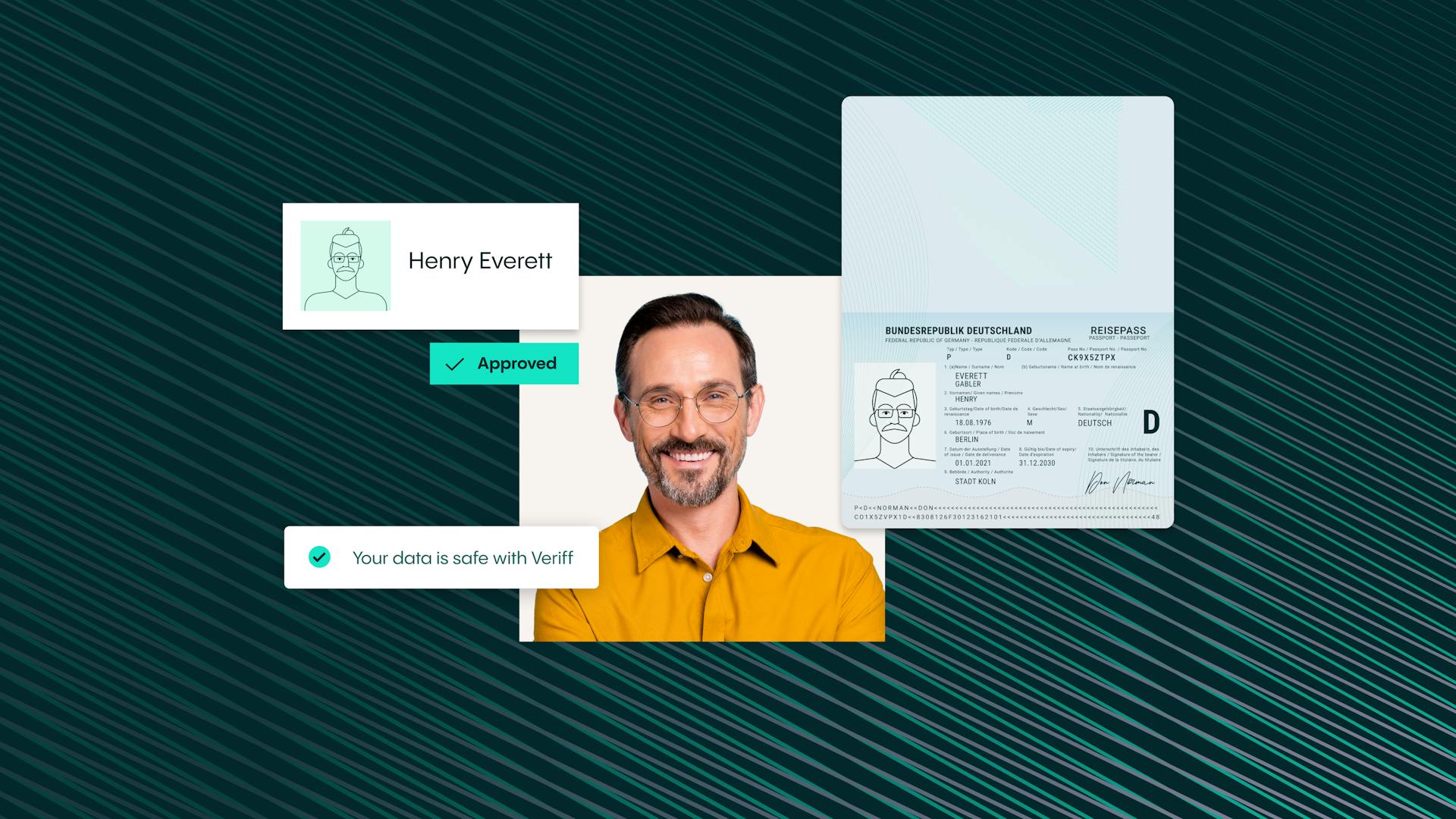

Gone are the days of rifling through paperwork; now, it's all about the click of a button and the flash of an ID. With online onboarding, you can access a world of financial products without ever leaving your couch. From bank accounts to credit cards, the possibilities are endless.

Chris Hooper

1. What is digital onboarding in financial services?

Given where we are today with digital transformation, the chances are that the vast majority of people have at some point experienced digital onboarding within financial services. This is because the days of going into a branch to open a bank account and carry out identity verification are very much behind us.

Instead, financial institutions carry out online onboarding – an automated process that allows people access to financial products and services, including traditional bank accounts, loans, and credit cards, or accounts with digital banks or neobanks. It comprises a set of steps that soon-to-be-users undertake in order to prove that they really are who they say they are by validating information about them against reliable sources and databases. This includes (but is not limited to):

- Verifying images of a government-issued ID such as a passport or driver’s license or national ID

- Verifying proof of address documents such as utility bills or bank statements

- Collecting biometric data such as facial recognition

What sets it apart from traditional onboarding is the fact that it’s done entirely online. This means that it takes place on websites or in an app – but not, for example, in a branch or on a premises - although even some physical or in-person onboarding processes are starting to include a digital element now too. The benefits of this are that the process tends to be fast, frictionless, and simple.

2. How does KYC enhance security in digital onboarding for financial services?

Know Your Customer (KYC) processes are an essential component of digital onboarding for financial institutions such as banks and credit unions. This is because legally, financial services have to comply with certain regulatory requirements, such as KYC and Anti Money Laundering (AML) compliance.

In simple terms, KYC enhances security in digital onboarding by providing businesses with a full and detailed understanding of who their customers and potential customers are, what they do, if they are legitimate users and, therefore, whether they should be doing business with them or not. As such, certain customer due diligence procedures have to be undertaken.

In order to do this, KYC solutions involve establishing the customer´s identity as part of the customer identification program (CIP). And, while it may vary around the world, CIP is a process that involves collecting and validating the individual’s full name, date of birth, and address and checking that the person providing the information is the same person the information belongs to. To do this, the individual will often be asked to provide a government-issued ID and a selfie.

3. How can businesses enhance the effectiveness of KYC by giving priority to digital onboarding for financial services?

By prioritizing digital customer onboarding, financial services companies are able to verify new customers’ data automatically. And because all of these procedures are automated, digital onboarding simplifies the process of security checks, therefore improving the effectiveness of KYC compliance.

What’s more, because online onboarding eliminates the need for manual paperwork and in-person verifications, KYC solutions are also faster and more efficient.

Digital onboarding also helps businesses streamline their client onboarding process and reduce the associated time and costs by eliminating the need for physical documents and in-person verification. What’s more, the KYC customer user experience is improved by making the process faster and more convenient.

Finally, digital onboarding allows regulated companies to take on customers from around the world while remaining compliant with complex and ever-changing KYC regulations. It also enables them to scale in unprecedented ways.

4. What are the primary types of customer onboarding processes involved in digital onboarding for financial services with a focus on KYC compliance?

Self-Service Onboarding

By automating your self-service onboarding capability in the right way, you create a faster and more efficient process. You can ensure the security of high-value transactions, all while empowering customers to oversee the process themselves in a quick and easy way. Instead of being guided and prompted by team members, customers are directed by resources that they can access themselves as the client onboarding process progresses. By using self-service onboarding, the time and effort spent achieving KYC compliance can be lessened. For instance, mobile apps and online portals, meanwhile, make it easier for customers to complete the onboarding experience and move through the KYC compliance process efficiently. By leveraging the convenience of apps and portals, onboarding completion rates can be increased, the user experience can be improved, and, crucially, the abandonment rate can be decreased.

Identity and document verification

Document verification is simply the process of verifying whether a government ID is real or fake. Document verification forms an extremely important part of the KYC compliance process.

Liveness detection / biometric verification

Biometric verification has become the benchmark for verifying identity. Whether utilizing facial recognition, voice analysis, or fingerprint scanning, biometrics provides an exceptionally personalized and virtually foolproof level of security. Notably, face "liveness" detection, whether through active or passive means, ensures that the presented biometric data is both genuine and up-to-date. Active liveness methods may prompt users for particular gestures or expressions, while passive techniques examine environmental cues to confirm authenticity. Moreover, the authenticated biometric can be employed for further authentication, thereby ensuring the presence of the verified user.

Become and stay KYC compliant

5. How does the integration of digital onboarding for financial services with KYC affect the effectiveness of fraud prevention and risk management?

The integration of digital onboarding processes for financial services with KYC serves a dual purpose – it not only effectively reduces the risks linked to fraudulent activities, it also plays a pivotal role in ensuring regulatory compliance.

From the risk point of view, KYC ensures that financial institutions are not extending credit to individuals or entities involved in illicit activities such as money laundering or financing terrorism. This will help ensure you stay on the right side of the law, guard you against being fined and protect both your organization financially as well as your brand value.

KYC also allows regulated companies to take a consistent, secure and compliant approach to meeting their regulatory responsibilities.

6. How does Veriff's KYC enhance both the efficiency and accuracy of digital onboarding for financial services?

Veriff’s KYC solutions are faster, more accurate, and built for a host of industries – including the banking industry and the digital banking industry. What’s more, our combination of AI and human verification teams ensures bad actors are kept at bay while genuine users experience minimal friction in their customer journey.

These tools include:

Document and Identity Verification

Onboard more genuine customers with Veriff's Identity and Document Verification solution. It is proven to deliver speed, convenience, and low friction for your users, resulting in high conversion rates, fraud mitigation, and operational efficiency for your business. Veriff’s Identity and Document Verification solution combines AI-powered automation with reinforced learning from human feedback and, if required, manual validation. With support for more than 12,000 document specimens from more than 230 countries and territories, Veriff offers speed, convenience, and reduced friction to convert more users, mitigate fraud, and comply with regulations.

Proof of Address (PoA)

We offer a seamless, one-step process for your users to submit their Proof of Address documents, meaning that less time and fewer resources are required in order to comply with regulations and get a comprehensive view of a user's identity.

AML Screening

With Veriff, complying with KYC regulations doesn’t mean compromising the user experience. Our automated AML screening and ongoing monitoring solutions help keep your business compliant, mitigate risk, and keep out fraudsters while still creating a seamless experience for your genuine users.

FAQ´s

1. Why is digital onboarding important for the financial services industry?

Digital or online onboarding helps financial services improve the speed of the onboarding process (what previously took an average of three weeks can now be completed in seconds) and decreases the level of friction experienced by customers. Conversion rates are also higher, security procedures take place in real time and everything can be done by anyone with an electronic device, a camera, and internet access. Digitally verifying your customer's identity will also protect your bank from fraud, scammers, and associated penalties and fees.

2. What are the key benefits of implementing digital onboarding in financial services?

The key benefits of implementing digital customer onboarding in financial services are:

- Time and money savings

- The ability to onboard customers no matter where in the world they are

- Speed – online onboarding can take a matter of minutes – making it much faster than conventional methods

- Simple and easy to use methods

- Less chance of human errors occurring

- Improved security.

- Overall, a digital onboarding process in financial services allows businesses to provide a customer-centred approach, reduce operational costs, and strengthen their compliance.

Explore more