California data privacy trends & compliance action points for financial services

This blog outlines key trends in California's evolving privacy landscape and offers actionable steps to help your organization safeguard consumer data, maintain compliance, and build trust with clients.

Margot Arnus

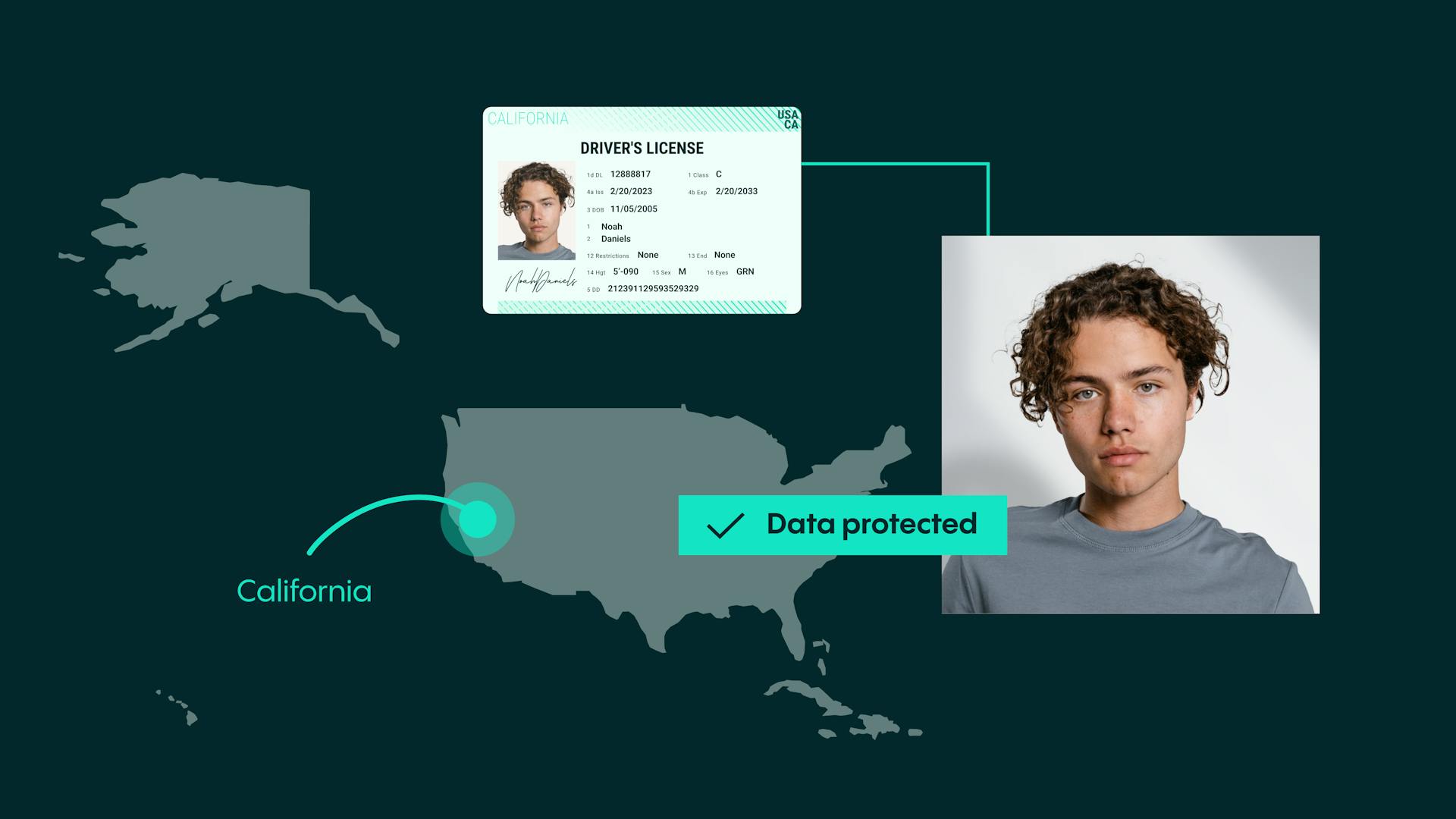

California’s data privacy laws, particularly the California Consumer Privacy Act (CCPA) and its amendment, the California Privacy Rights Act (CPRA), are transforming how businesses, including in the financial services sector, handle personal data.

Financial services (FinServ) firms must be prepared to comply with these regulations, as they manage sensitive consumer data such as account information, credit histories, transaction records but also Social Security numbers and data used for their customer’s authentication.

Here are key trends and practical action points to help financial services organizations stay compliant with these evolving laws.

1. Expanded consumer rights

California residents have the right to:

- Opt out of the sale of their personal information.

- Request corrections to inaccurate personal data.

- Limit the use and disclosure of sensitive information, including financial records and social security numbers.

Action Point:

- Implement a data request portal where consumers can easily exercise these rights. This portal should allow users to opt out of data sales, request corrections, and limit data usage.

- Implement measures to confirm the requests are “verifiable”, i.e., the consumer making the request is the consumer about whom you have collected information.

2. Broader scope for businesses

Businesses subject to these laws include those with:

- Over $25 million in annual revenue.

- Sells or shares the personal data of 100,000 or more California residents.

- Deriving more than 50% of their annual revenue from selling consumer data.

Action Point:

- Audit your data collection and sharing practices. Ensure you're tracking the volume of personal information your business handles, and whether it falls under CCPA/CPRA requirements. Keep in mind that in California, not only selling (for monetary or other valuable consideration) but also sharing (no money is exchanged) is heavily regulated by the State’s privacy law. If you deal with indirectly identified consumers through third-party data processors, ensure these relationships are compliant. If you deal with indirectly identified consumers through third-party data processors, ensure these relationships are compliant.

3. Sensitive Personal Information and Data Protection

In addition to the more common sensitive data categories, CCPA explicitly covers as sensitive data also mail, email, and text messages, as well as social security numbers, identification documents and financial account data. Financial services firms, which often handle large amounts of such sensitive information, are required to ensure its protection.

Action Point:

- Enhance your data security measures and keep in mind California’s broad scope of sensitive data. Invest in encryption, anonymization, and data minimization techniques to safeguard consumer data. Ensure these practices are clearly outlined in your privacy policy.

- Limit the use of sensitive data unless it’s essential for business operations, and ensure consumers can control how their sensitive data is used.

4. Regulatory enforcement

California is also unique when it comes to regulatory authorities. In addition to the California Attorney General, the California Privacy Protection Agency (CPPA) is an “independent watchdog” responsible for enforcing these privacy laws. Non-compliance can result in significant penalties.

Action Point:

- Conduct regular compliance assessments to ensure you’re following both the CCPA and CPRA. This includes responding promptly and accurately to consumer requests as well as continuous monitoring and improvement of your privacy practices. It’s useful having a designated data privacy team or even appoint an individual to own this topic, similar to the GDPR concept of having a Data Protection Officer (DPO). Having a clear owner for the topic helps to manage compliance efforts.

5. Data transparency and consumer trust

Consumers already had under CCPA the right to know what personal information businesses collect and how it’s used . However, the CPRA added several new rights such as the right to correct inaccurate data, the right to opt-out of selling/sharing, or the right to limit use of the sensitive data. The rules concerning exercising these rights and fulfilling the company’s obligations towards the consumers are much more granular in California than in several other state level privacy laws.

Action Point:

- Create a transparent privacy policy that is easy to understand. Pay attention to the detailed requirements and specific wording suggestions provided by the Californian legislators. It should detail what types of data you collect (e.g., social security numbers, email addresses, consumer identification data, account data etc.), how it’s used, and how consumers can opt out or request corrections.

- Use clear language to explain how you handle indirectly collected data, ensuring customers feel confident about your data management practices. While the Californian law relies on the “opt-out model” for sensitive data processing, it’s still important to provide sufficient information to the consumer for effective compliance setup.

6. Compliance pressure on financial services

The financial services sector is particularly impacted by these regulations, given the vast amounts of personal and financial information collected.

Action Point:

- Train your customer service and compliance teams on how to handle CCPA/CPRA consumer requests, including how to process opt-out requests, fulfill correction requests, and delete personal data when necessary.

- Implement automated tools to handle these requests efficiently and maintain records of compliance.

- Take a look at the agreements concluded with your service providers and any third parties. The CCPA also imposes several requirements on these, making sure you use trustworthy cooperation partners is the key to your success.

Practical steps to get ahead of compliance challenges

Perform a data inventory

- Identify all sources of consumer data (including email, text messages, consumer accounts, as well as your website visitor data) and classify them based on sensitivity and risk.

Review third-party contracts

- Ensure your vendors and partners are also compliant with California’s privacy laws, particularly if they buy, sell, or share consumer data.

Designate ownership

- Ensure clear accountability by assigning ownership of the compliance framework. For an effective setup, dedicated individuals must build the structure and oversee that all employees follow internal policies and guidelines accurately.

Establish a response framework

- Develop internal processes for responding to consumer requests to access, delete, or correct personal information within the legal time frame.

Monitor CPPA guidelines

- Regularly check updates from the California Privacy Protection Agency to stay ahead of new regulatory developments.

Conclusion: Preparing for continuous evolution

For financial services firms, compliance with the CCPA and CPRA is not just about ticking boxes—it's about ensuring data transparency, enhancing consumer trust, and staying ahead of regulatory changes. With the California Privacy Protection Agency taking a lead in enforcement, it’s essential to implement these practical steps now to avoid penalties and ensure seamless data privacy compliance.

For further information, explore these resources:

- California CCPA overview

- California CPRA overview

- Bloomberg Law insights on California privacy laws

- ADP’s guide to the California Privacy Rights Act

By taking action now, financial service companies can safeguard sensitive information, build trust with consumers, and maintain compliance with California's data privacy laws.