The CX Revolution: How biometric identity verification is redefining customer account verification

Online fraud is a growing threat to consumers and businesses. Our recent Veriff webinar delved into the danger and outlined how biometrics can boost security while protecting the customer experience (CX).

Chris Hooper

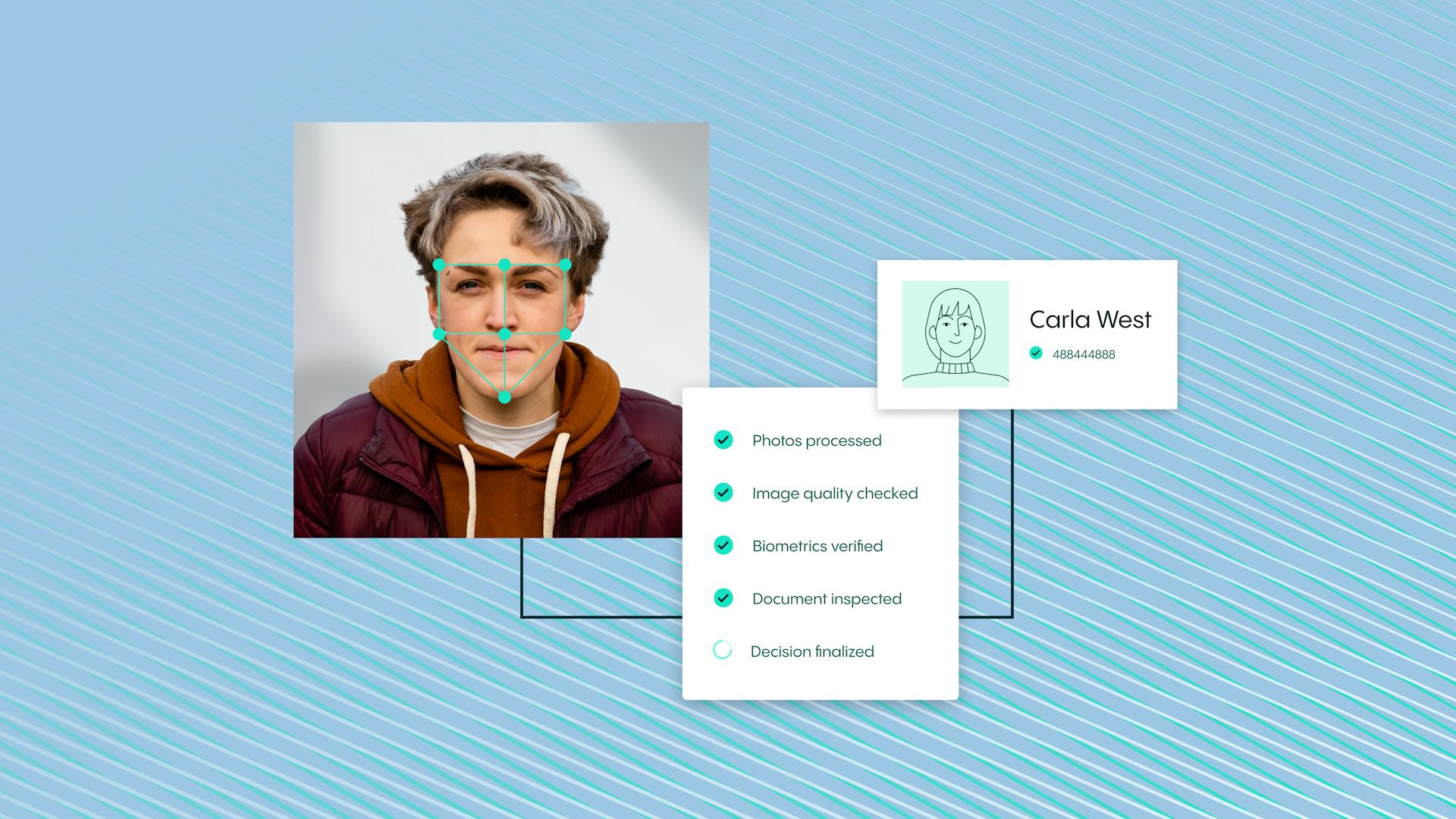

In ‘The CX Revolution: How biometrics are redefining customer account verification,’ Veriff’s experts outlined the specific threats we’re seeing and how Biometric Authentication is protecting our customers.

Here are five key takeaways.

1. Online fraud is increasing – and becoming more sophisticated

Chris Hooper, Global Director of Content and Creative, outlined the growing threat from online fraud. He noted the increasing trend we’ve seen across our recent Fraud Reports, with a 20% increase in fraudulent attempts to access our customers’ services between 2022 and 2023.

Importantly, the nature of fraud is changing, something we’ve seen in our surveys and in our own interactions. Fraudsters are turning to AI to turbocharge their criminal activities. “The tools they’re using are more sophisticated – and they’re also easier to use,” Chris warned.

"The Veriff Fraud Index survey showed that 75% of end users consider a company’s history of fraud [prevention] before signing up to a new online service or platform”

2. Customers demand security and a seamless experience

Customers are taking notice of the growing threat from fraud. As Chris noted, the Veriff Fraud Index survey showed that 75% of end users “consider a company’s history of fraud [prevention] before signing up to a new online service or platform”.

At the same time, CX is also extremely important, said Geo Jolly, a Veriff Product Manager who focuses on biometrics. Sometimes when organizations seek more data from customers, “they create a huge amount of friction”, he noted, which can be costly for business.

“That’s where biometrics come in. With Veriff’s Biometric Authentication product, the user begins with a one-off identity verification (IDV) session. From that point, they simply take a selfie and the AI-powered technology conducts biometric analysis in a matter of seconds to ensure that the customer receives their decision quickly.”

"In mobility, it’s essential to stop fraudsters from accessing vehicles, which “could be really, really, dangerous”

3. Use cases vary across industries …

Of course, different sectors have different needs, explained Margit Kubi, Associate Customer Success Manager. In the financial services sector, for instance, it’s important to authenticate a customer’s identity in a transaction to ensure that money goes to the right place.

In mobility, it’s essential to stop fraudsters from accessing vehicles, which “could be really, really, dangerous”, noted Margit.

“Online marketplaces must protect restricted goods – for instance, to ensure that underage customers can’t access alcohol – while in gambling it’s vital to prevent the danger of multi-accounting, where a fraudulent user creates as many accounts as possible to attempt to claim the bonuses offered by companies.”

4. … But no matter the sector, biometrics are the best defense

Biometrics can meet all these needs. It’s all about secure authentication, combined with CX. Whether you’re organizing a financial transaction, hiring a car or signing up to a dating website, “you want to be sure the transaction is legitimate and it all goes as smooth as butter”, says Margit.

Whether it’s the threat of account takeover, velocity abuse, the danger of multi-accounting, or if your users simply need to recover their accounts, facial biometrics offers the best protection. With just a simple selfie, it’s easy for companies to re-authenticate users and for customers to seamlessly log back into their accounts.

5. Biometrics combine security with the optimum CX

Biometric identifiers offer unparalleled security. At the same time, we want to avoid friction. With our Biometric Authentication product, the user takes part in a simple process, in which they know exactly what is happening at any point. Importantly, we don’t store the actual image - our biometric analysis is done using a numerical representation based on that image.

Through these means, biometrics deliver trust, as Geo explained.

“When the customer wants to authenticate someone, what Veriff is giving is trust – we are ensuring that you can trust this user.”

“When the customer wants to authenticate someone, what Veriff is giving is trust – we are ensuring that you can trust this user.”

Watch webinar

Want to see the complete webinar? Sign up and get full access.

Learn more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms